Last Updated December 12, 2025

Invoices are one of the earliest expressions of written records, being traced back to 2900 BCE when merchants would carve details of transactions on stone tablets.

Thousands of years later, they remain an essential component of any transaction between parties. And while the layout of a modern-day invoice looks quite different from 5000 years ago, its function in business remains the same. But those who are new to the accounting or business realm might be wondering what an invoice actually is, and how they’re different from other financial documents such as bills and purchase orders.

Even if you’re a business owner already familiar with invoices, it’s helpful to brush up on the purposes of an invoice, the different types of invoices, and the invoicing process step-by-step. Doing so will reduce your chances of having to resolve situations where customers aren’t paying invoices on time and can help you become a savvier business owner.

With that being said, let’s cover everything you need to know about invoices.

Key Takeaways

- An invoice is an itemized document that requests payment, details the cost of goods or services, and provides a record of the transaction for both buyer and seller.

- Invoices include essential information such as invoice number, issue date, contact details, itemized goods or services, date of service, and payment terms.

- There are different types of invoices, including sales invoices, expense reports, bills of sale, debit notes, pro forma invoices, and past-due invoices, each serving a unique purpose.

- The invoice process involves creation, delivery to the buyer, approval, payment, processing, and archiving, ensuring proper record-keeping, cash flow management, and accounting accuracy.

What Is an Invoice?

An invoice is an itemized document that is an essential component of any business’ accounts payable and accounts receivable processes.

Regarding the purpose of an invoice, it serves three main functions:

- It informs the buyer what products or services the seller (or vendor) has provided.

- It informs the buyer the cost of those products or services.

- It provides a record of a transaction.

An invoice is used as a document to request payment from customers, though it also serves as a record-keeping document for the buyer and the seller with the help of invoice numbers. Accounts payable and accounts receivable departments should have a list of all invoices and invoice numbers sent and received so they can easily refer back to any given transaction.

This might seem like one of the more tedious aspects of doing business, but it’s important — well-managed accounting efforts can impact profitability. Invoices are a vital part of the accounting and cash flow audit process and are regularly used in business transactions.

What Information Is Included on an Invoice?

While every invoice might look a little bit different depending on the invoice template a business chooses, all invoices should include the following:

- Invoice number

- Date of issue

- Contact information of the business

- Description of the goods and services provided

- Date of service

- Payment terms

An example of invoice payment terms might be “Net 30”, meaning the customer has 30 days to pay from the date of issue. An invoice due date calculator can help ensure your customers are abiding by payment terms.

Types of Invoices

While the purpose of every invoice is uniform, there are different types of invoices, and the invoice type is usually dependent on the type of transaction.

Some types of invoices include:

Sales Invoice

A sales invoice is any document requesting payment. It is designated for the sale of goods or property.

Expense Report

Employees create an expense report when they need reimbursement for business-related expenses. For example, if a medical device sales representative drives to an out-of-state hospital to pitch their company’s product, they would eventually create an expense report to receive reimbursement for costs such as gas money, parking, and lunch.

Bill of Sale

A bill of sale is written out when one party transfers property or sells goods to another party. It serves as a proof of purchase and transfer of ownership.

Debit Notes

Debit notes are created by vendors and sent to buyers to notify them of outstanding debt. Also known as a debit memo, a debit note is common in B2B transactions.

Pro Forma Invoice

A pro forma invoice is what a business sends to a client before any services are provided. It is an estimation invoice that notifies the client of estimated costs for the project. While pro forma invoices can be helpful for the client, they are usually altered once a project is finished due to changes in costs, such as more or less hours worked than expected.

Past Due Invoice

Just what it sounds like, a past-due invoice means a business has failed to make payment by the invoice’s due date. Past-due invoices are unfortunately a common occurrence in the business world and can significantly affect a business’ cash flow.

Related: Email Templates to Politely Ask for Payment Professionally

Invoice Example

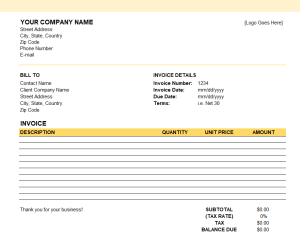

Professionalism goes a long way when running a business. You don’t want to send an invoice that looks like it was thrown together in two minutes.

Instead, create an invoice template that is neat and easy-to-follow. Since not every business owner possesses design skills, it’s common to use professional invoice template services such as Quickbooks and PayPal. If you’re planning on using invoicing software, you can expect the software to include an invoice template.

If you want to put your design skills to the test, below is an example of a professional invoice:

Additionally, altLINE has some downloadable invoice templates that can help you get started:

How Does the Invoice Process Work?

The invoicing process from start-to-finish has changed over the years thanks to the development of email and invoicing software. Invoicing software in particular has helped ease the load for employees handling accounts receivable and accounts payable processes, providing features like one-click payment options and automated payment reminders.

Here’s how the invoicing process typically looks like step-by-step:

1. Seller creates an invoice

Once the goods or services are provided, the vendor begins the process of creating an invoice. If you are a business owner creating an invoice, you will want to use a professional invoice template.

2. Seller sends the invoice to the buyer via mail, email, or invoicing software

After the invoice is created, it’s time for the vendor to send the invoice to the purchaser. There are different ways to send an invoice, so make sure you’re aware of these various options. Remember to stay well-organized pertaining to your accounts payables, keeping track of things such as net payment terms for each of your buyers so you know when payment is due.

3. Buyer receives the invoice and sends it to an authorized approver

Regardless of how the buyer receives the invoice, they will have to send it to an authorized approver before payment can be made. This step is a critical component of the accounts receivable audit process.

For example, if a business’ marketing director signed a contract to begin a relationship with an email marketing vendor, the business’ accounts receivable department going forward would send that vendor’s invoices to the marketing director for approval.

But we know that businesses come in all shapes and sizes; small business owners wear many hats and independent business owners oversee all decision-making processes. The person who handles all accounting efforts may be the same person who approves invoices. If this rings true for your business, this step is simplified. You’re in full control.

4. Buyer authorizes and submits invoice payment

Once the authorizer approves the invoice, the invoice can be paid.

Just as with sending an invoice, there are different methods to pay an invoice, including via:

- Credit card

- Wire transfer

- Online payment

- Automated payment (typically via invoicing software)

To accelerate the process, both buyer and seller should communicate and clarify the method of payment before the working relationship begins.

5. Invoice is processed for payment

The vendor collects the invoice and processes it for payment. Typically, this happens via common invoice payment methods such as ACH, wire transfer, or a check.

6. Invoice and payment information is archived

Once payment has been processed, both the accounts payable and accounts receivable departments must keep documentation of the invoice payment for record-keeping purposes. Ensuring your books are up-to-date and accurate will save time in preparation for a year-end accounting audit.

Invoice FAQs

What does invoicing mean in business?

Invoicing means the seller is sending a legally enforceable document to the buyer, requesting payment for goods or services.

What is the purpose of an invoice?

An invoice informs the buyer what goods or services were purchased, the cost for those goods or services, and requests payment. Once payment is processed, it then provides a record of the business transaction that can be documented by both accounts payable and accounts receivable teams.

What is an invoice number?

An invoice number is the number listed on top of an invoice. Also known as an invoice ID, an invoice number is important because – when record-keeping – it allows a business to effortlessly refer back to specific transactions.

How do I manage unpaid invoices?

It’s highly likely that business owners will at some point deal with slow-paying customers who let invoices go unpaid or past-due. While this is an unfortunately common occurrence, there are some tactics you can use to increase the likelihood of on-time payment:

- Send automated payment reminders

- Offer multiple payment options

- Charge late payment fees or offer early payment discounts

- Call your customer

- Use invoice factoring to manage outstanding invoices and payment collection

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.