What Is an Opportunity Cost and How Is it Calculated?

Last Updated May 13, 2024

Opportunity cost is a popular term not only in the business and financial realm, but in everyday conversation as well. These costs refer to what you sacrifice when you choose one option over other alternatives, however since this term is used so often and generally, it’s important to understand how you calculate opportunity cost, including the formula for opportunity cost and what it all means for your business.

Continue reading to find out.

What Is Opportunity Cost?

An opportunity cost is an opportunity or the opportunities that a person forfeits when they take a particular course of action.

For example, if a chain fast food restaurant serves Coke products, their opportunity cost is Pepsi products. Since the restaurant partnered with Coke, they cannot legally sell Pepsi as established in their contract.

It is imperative for a business owner to make sacrifices. Time, money, and relationships are just some of the things that you may give up for the sake of running a successful business.

Opportunity costs are used to calculate the advantages and disadvantages of the decision-making process. They can tell a lot about future gains, losses, and returns. In a nutshell, you’ll use them to calculate a business’s capital structure.

Why Is Opportunity Cost Important?

Companies mainly analyze opportunity cost when in the process of making critical business decisions. By weighing the risks and rewards of making alternative options, a business can choose the best course of action.

Doing this will help predict a business’s working capital through looking into potential debt, equity, and assets as variables if a certain decision is made. Knowing your company’s financial outlook can help formulate your future business plan and business budget, knowing how and when to make adjustments as necessary.

Opportunity costs are also used in hindsight to see where the business would have been if it had taken a specific action in the past. It won’t help change the concurrent state of the company, but it will help calculate future opportunity costs and allow a higher degree of accuracy for future projections.

How to Calculate Opportunity Cost

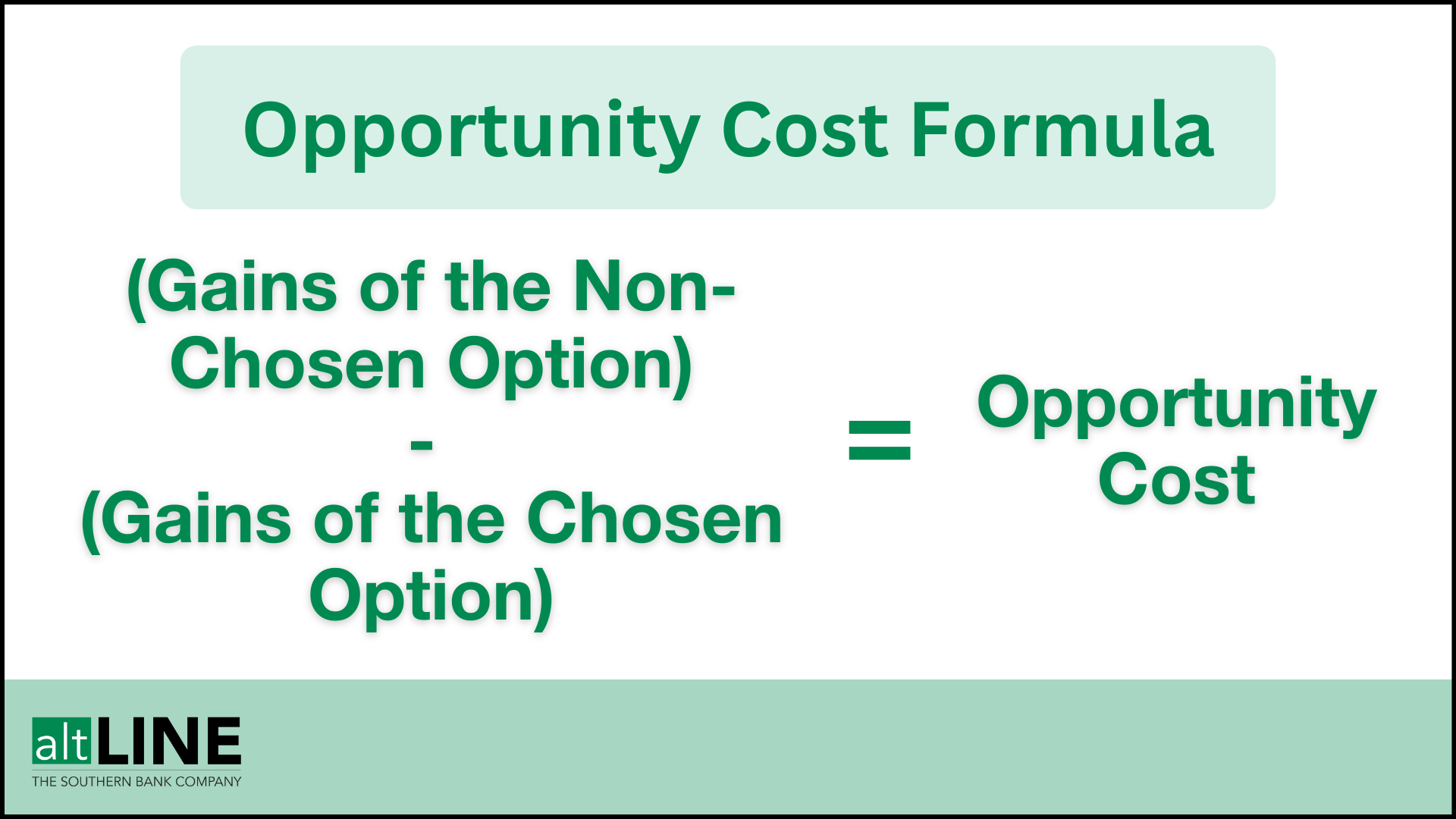

For investors and business owners, calculating opportunity cost usually estimates economic returns/losses. For that, there is a simple formula you can use to calculate opportunity cost:

Opportunity Cost = (Gains of the Non-Chosen Option) – (Gains of the Chosen Option)

When determining the gains of both options, you’ll likely have to make rough estimates based on historical performances and projected outcomes. This method is popular with investors who use it to calculate the most profitable stocks.

You can use this opportunity cost formula to calculate the cost of multiple opportunities, but it is most accurate as a two-variable function. Unless by choosing an option, you forgo various possibilities that you could have taken at once, you should calculate each opportunity cost individually.

Example of Calculating Opportunity Cost

Imagine you’re the owner of a supermarket. You can choose to source your chicken from organic-based farms and non-organic farms.

Organic chicken is more expensive, but certain customers are willing to pay more for it, and you can market it as healthy. On the other hand, non-organic chicken is cheaper, and more people are likely to buy it.

After crunching the numbers, you expect a 2% increase in overall sales from selling organic chicken and a 5% increase from selling non-organic chicken. However, you know that selling organic chicken is the generally healthier product and easier to market than non-organic chicken, so you choose organic. Using the opportunity cost formula:

Opportunity Cost = (Gains of Selling Non-Organic Chicken) – (Gains of Selling Organic Chicken)

You find that your opportunity cost would be 3%.

Opportunity Cost = 5% – 2% = 3%

Therefore, you’re losing out on 3% in overall sales. However, you may move ahead with this decision and find that losing 3% in sales is tolerable because of long-term benefits such as marketability and brand reputation.

How Do Investors Use Opportunity Cost?

Opportunity cost is utilized widely by investors to calculate potential returns from various stocks. They compare different companies’ yearly, quarterly, and monthly returns and use the opportunity cost formula to predict how the market will move.

It may be used in an attempt to generate a capital gain or as an indicator of when to or not to invest. The opportunity cost ultimately determines which company assets are most worth it to hold and which fall short.

The opportunity cost can also help investors determine how much they should invest in a specific stock. If the function shows low risks, it may prompt an investor to invest more capital volume.

Related: Small Business Revenue Statistics

Other Applications of Opportunity Cost

Since the opportunity cost formula is a very versatile function, it has a wide array of applications that haven’t been mentioned in this article. One such application would be calculating non-financial opportunity costs.

The equation is best suited for numerical variables but can be used to determine the benefits of business relationships, customer ratings, and company reception.

Of course, it’s not only businesses or investors who use opportunity costs, and just about anyone can use them. It’s a very straightforward yet versatile function that can aid buyers in making big purchases such as houses, cars, and tuition.

The opportunity cost formula is also practical for time management, and millions of people unknowingly use it every day. By consciously employing opportunity costs in daily life, an individual can immediately increase productivity and organization.

Limitations of Opportunity Cost

Perhaps the most significant limitation of opportunity costs is that businesses and investors usually base them on estimations and guesswork. Historical records can’t predict the future, and you’ll find that the formula isn’t precisely accurate.

Opportunity costs are suitable for speculation but not for calculating exact numbers.

There is also the issue of factors that cannot be represented with numerical data. Calculating the opportunity cost of elements that have more abstract values may hinder and obstruct the thought process.

In-Summary: What Is Opportunity Cost?

Finding opportunity cost is crucial for businesses to determine since they can help formulate capital structure and map out the potential risks of making a specific choice. They’re also an essential part of the investing process because of their ability to project capital gain/loss potential.

Opportunity costs have a wide array of applications for business owners, investors, and in everyday life. For example, finding opportunity cost can be helpful when performing a more holistic working capital analysis.

Overall, doing so can help determine what to do in a make-or-break situation, or in a more general sense, give you an idea of where your business might stand financially because of a choice you make.