If Small Businesses Are Doing Well, Why Are Owners So Pessimistic?

Last Updated December 19, 2023

Ground Picture // Shutterstock

The economy has small business owners in a conundrum.

Objectively, small businesses are doing well. Consumers are still spending. Retail sales rose to more than two times what economists predicted as of September 2023, according to the Commerce Department. But, confidence among these business owners is waning, and many are pessimistic about the future.

Several economic factors contribute to business owners’ pessimism, but inflation and labor quality lead the way, according to the National Federation of Independent Business’ September 2023 analysis. Nearly a quarter of businesses claimed each as their single most critical issue, leading the next-highest identified problem (taxes) by 10 percentage points.

Despite persistent interest rate hikes, inflation is still about a percentage point higher than the Federal Reserve’s goal of 2%. Home rental prices—a major contributor to inflation—are cooling off, but the conflict in the Middle East may cause energy prices to spike. Nonprofit research organization The Conference Board believes the resiliency in consumer spending won’t last.

Consumers’ income growth hasn’t kept pace with inflation, and they’re draining the savings accrued during the COVID-19 pandemic. Household debt is a growing issue, reaching $17.06 trillion in the second quarter after a $16 billion increase, according to the New York Federal Reserve. The pandemic-era pause on student loan repayments ended in October, forcing many to redirect their money, which kept it out of the economy.

Still, for now, the NFIB survey shows small businesses are, by many measures, doing well. altLINE dug further into why small businesses are skeptical about the next few months despite those successes.

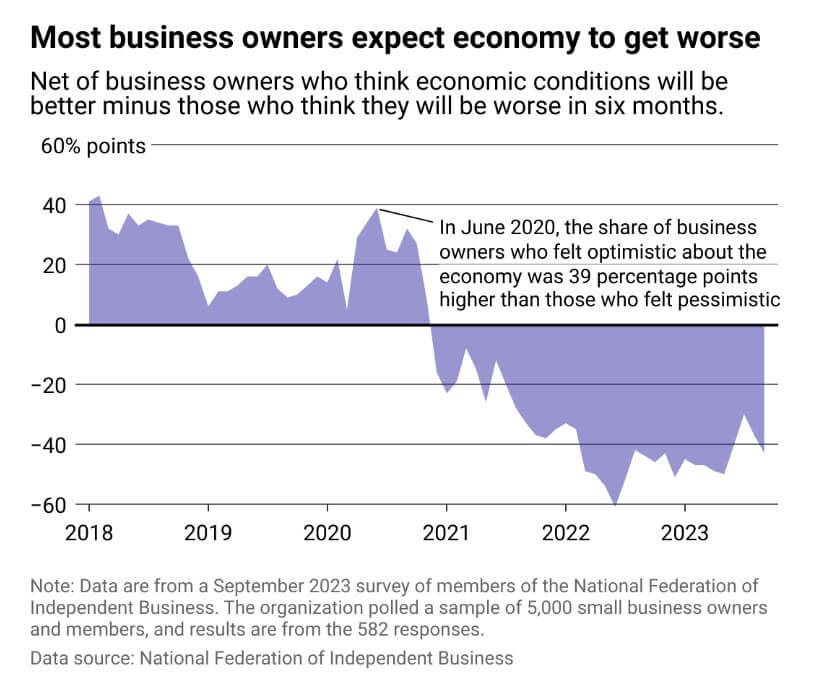

Pessimists outweigh optimists for nearly 3 years

Since 1973, NFIB Index results have accurately predicted recessions. For over a year, small business owners have indicated via NFIB Index responses that a recession is coming, but it has yet to arrive.

The NFIB Index tracks business owners’ optimism through an index that measures a set of “hard” and “soft” components. The “hard” components include things like earnings and hiring and capital expenditure plans, while “soft” numbers include expectations around business conditions, sales, and credit conditions. Historically, these two indicators have moved in sync, but they had a major deviation in 2020 with the emergence of the COVID-19 pandemic. Business owners had dire expectations for their business’ future—even amid measured improvements.

In September 2023, NFIB’s Optimism Index dropped to 90.8, well below its decadeslong 98-point average. The index is calculated as part of a survey, which was circulated among 5,000 NFIB member businesses and received 582 responses.

So, is a recession coming?

More small businesses have seen sales decline than increase over the past few months, but the report shows that divide is shrinking. Still, over the next three months, those expecting lower sales outweigh those expecting higher sales by about 13 percentage points.

Expectations for the economy continue to suffer—and at a much higher rate. Business owners anticipating the economy to worsen currently outweigh those anticipating it to improve by about 43 percentage points. The naysayers have comprised the majority since December 2020. Expectations about getting good credit terms have fallen, and business owners are holding off on inventory increases and expansion plans.

After the economy shrank in the first half of 2022, economists predicted a nationwide recession would follow, but it hasn’t, per Reuters. Gross domestic product has grown, the labor market is still robust, and consumers still spend. We’re not quite in the clear, though: A New York Federal Reserve analysis indicates a 56% recession probability by September 2024.

One factor keeping the economy from recession has been a resilient labor market. Although job creation slowed in October 2023, the unemployment rate remains low, at 3.9%, according to the Bureau of Labor Statistics. NFIB found that employment levels at small businesses remain fairly consistent as well but struggle to fill openings. Of those hiring or trying to hire, 93% had few or no qualified applicants for recent job postings.

The labor market means business owners must raise salaries to attract good workers. Together, with material and energy inflation, they are then forced to raise prices. NFIB notes this contributes to further inflation increases, continuing the cycle that could prime the economy for recession.

Written by Jill Jaracz. Data work by Paxtyn Merten. Story editing by Ashleigh Graf. Copy editing by Paris Close.