How to Read and Analyze Your Profit & Loss Statement

Last Updated May 22, 2024

At the end of the day, even the most well-run businesses need to make a profit. If not profitable, a business won’t be able to sustain operations.

Proactive business owners and decision-makers understand this reality and spend time regularly reviewing profit & loss statements. This essential financial statement guides managing your cash flow and understanding the overall profitability of a company.

Here, we’ve created a helpful guide on how to read a profit & loss statement to inspire confidence that you’ll be able to successfully analyze your finances.

What Is a Profit and Loss Statement?

A profit and loss statement, also known as an income statement, tracks a company’s revenues, expenses, and profit over a specific period. This document is a financial snapshot and reveals the outcome of business activities. It highlights whether the company made a profit, broke even, or incurred a loss.

For business owners, investors, and creditors, the P&L statement provides insight into the company’s efficiency, cost management, and revenue generation capabilities. It helps you gauge financial health, make informed decisions, and strategize for the future.

The profit and loss statement is one of the three major financial statements that all business owners should routinely create and review, the other two being the business balance sheet and statement of cash flows.

Example of a Profit and Loss Statement

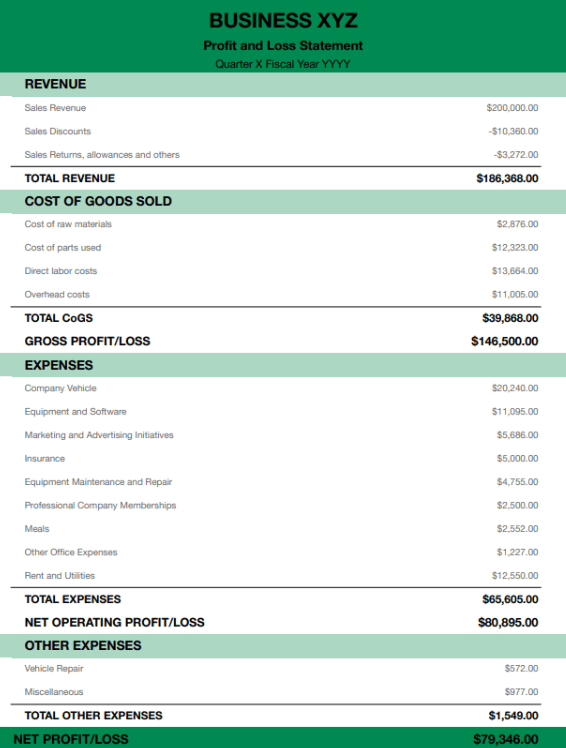

Below is an example of how to make a profit and loss statement and what yours might look like.

We’ll break down how to understand and read a P&L statement in a bit, but note that revenue typically goes on top, followed by COGS, followed by expenses.

Understanding a Profit and Loss Statement

Diving into the P&L statement is how you can understand a company’s financial performance. It’s a roadmap through the financial implications of business decisions, market conditions, and other pivots. This type of knowledge helps you work toward fiscal health.

The Purpose of a P&L Statement

The P&L statement’s primary purpose is to provide a clear picture of a company’s profitability over time. It helps stakeholders with the following:

- Evaluating operational efficiency: How well does the company convert revenue into profit?

- Making informed decisions: Insights from the P&L guide strategic budgeting, planning, and investment.

- Tracking financial performance: It offers a benchmark for assessing progress against goals, budget, and historical performance.

What Goes on a P&L Statement?

A P&L statement breaks down the financial activities of a company into various components. Each tells an important part of the company’s financial story. Here’s what goes on the document:

- Revenue: Total income from goods sold or services provided.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold.

- Gross Profit: Revenue minus COGS, indicating the efficiency of production and sales.

- Operating Expenses: Costs related to running the business that are not directly tied to production, including salaries, rent, and utilities.

- Operating Income: Gross profit minus operating expenses, showing the profit from core business operations.

- Non-Operating Income and Expenses: Revenue and costs not related to the primary business activities, such as interest income or losses from investments.

- Net Income: The bottom line—calculated as operating income minus non-operating expenses and taxes—represents the total profit or loss.

How to Read and Analyze Your Profit and Loss Statement

Analyzing your P&L statement is an art, and mastering it means you can transform numbers on a page into actionable insights. Here’s how you do it.

Define Your Revenue

Start by examining your total revenue. This figure represents the income generated from all sources, including sales of products or services before any expenses are deducted. This is where you identify growth areas and potential vulnerabilities.

Calculate Your EBITDA (Operating Income)

EBITDA (earnings before interest, taxes, depreciation, and amortization) offers a clear view of your company’s operational profitability. Subtract COGS and operating expenses from your total revenue to find this number. EBITDA reveals the profitability of core business activities, excluding the effects of financing and accounting decisions.

Compare with Previous P&L Statements (if Applicable)

Historical comparison provides context for your current financial status. Reviewing past P&L statements helps identify trends, growth patterns, or areas requiring attention. Such comparisons spotlight the effectiveness of strategies implemented and guide future operational adjustments.

Note Changes in Expenses—Were They Worth It?

Scrutinize shifts in your expense categories. An increase in marketing costs, for instance, should correlate with revenue growth. Evaluating the return on expense increases can inform more efficient budget allocations and operational improvements.

Consider Seasonality

Seasonal trends can significantly impact your P&L. Recognizing these patterns ensures accurate performance assessment and aids in planning for predictable fluctuations in revenue or expenses, enabling more strategic financial management.

Compare Findings with Your Business Budget

Align your P&L findings with your budgeted projections. This comparison reveals where actual performance deviates from expectations, providing a basis for adjusting financial forecasts or operational strategies to meet your business objectives.

Analyze Whether You Are in Line with Your Company Goals

Lastly, gauge your financial performance against your overarching company goals. Are you on track to achieve your targeted profit margins or revenue growth? This final step ties the financial details back to your business’s strategic vision, ensuring that every dollar spent or earned serves your broader ambitions.

In-Summary: Analyzing a Profit and Loss Statement

A profit and loss statement, or income statement, is one of the three essential financial documents for a reason—it provides crucial intel regarding a business’s financial performance. However, failing to properly analyze your P&L statement defeats the purpose of creating it altogether.

By learning how to analyze this document, you can now more easily link your three financial statements together to gain the most holistic picture of your business’s performance possible.

How to Read a Profit and Loss Statement FAQs

What should I look for on a profit and loss statement?

Key elements to focus on include revenue trends, gross profit margin, operating expenses, and net income growth.

Where is revenue on a profit and loss statement?

Revenue is typically at the top of the P&L statement, often referred to as the “top line.” It aggregates all income from sales, services, and other business activities before any expenses are deducted.

Where do gains and losses go on a profit and loss statement?

Gains and losses from non-operational activities are recorded below operating income. This section includes items like interest income, losses from asset sales, or other one-time events. They provide insight into the financial impact of activities outside the core business operations.

What is cost of goods sold on a profit and loss statement?

Cost of goods sold (COGS) appears just below revenue and represents the direct costs attributable to the production of the goods sold or services provided. This includes materials, labor, and overhead directly involved in creating the product or service.

What is the bottom line of a profit and loss statement?

The “bottom line” refers to the net income, located at the statement’s end. It shows the company’s final profit or loss after all expenses—including COGS, operating expenses, interest, and taxes—have been deducted from total revenue. This figure is crucial as it provides a clear indicator of the company’s overall profitability during the period.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.