Is Invoice Factoring Float Costing You?

Last Updated May 15, 2023

Every invoice factoring company structures a deal a little differently, so it’s often difficult to compare proposals. By focusing on a few key aspects of invoice factoring agreements, we aim to help business owners make better, more informed financing decisions. We’ll be taking a closer look at four important areas of an invoice factoring agreement: exit terms, float, invoice factoring costs and notice of assignment.

“Float” tops the list of often unnoticed or misunderstood variables affecting the true cost of an invoice factoring arrangement. In fact, float days combined with common factoring pricing structures can increase your financing costs by more than 40%.

What is Invoice Factoring Float?

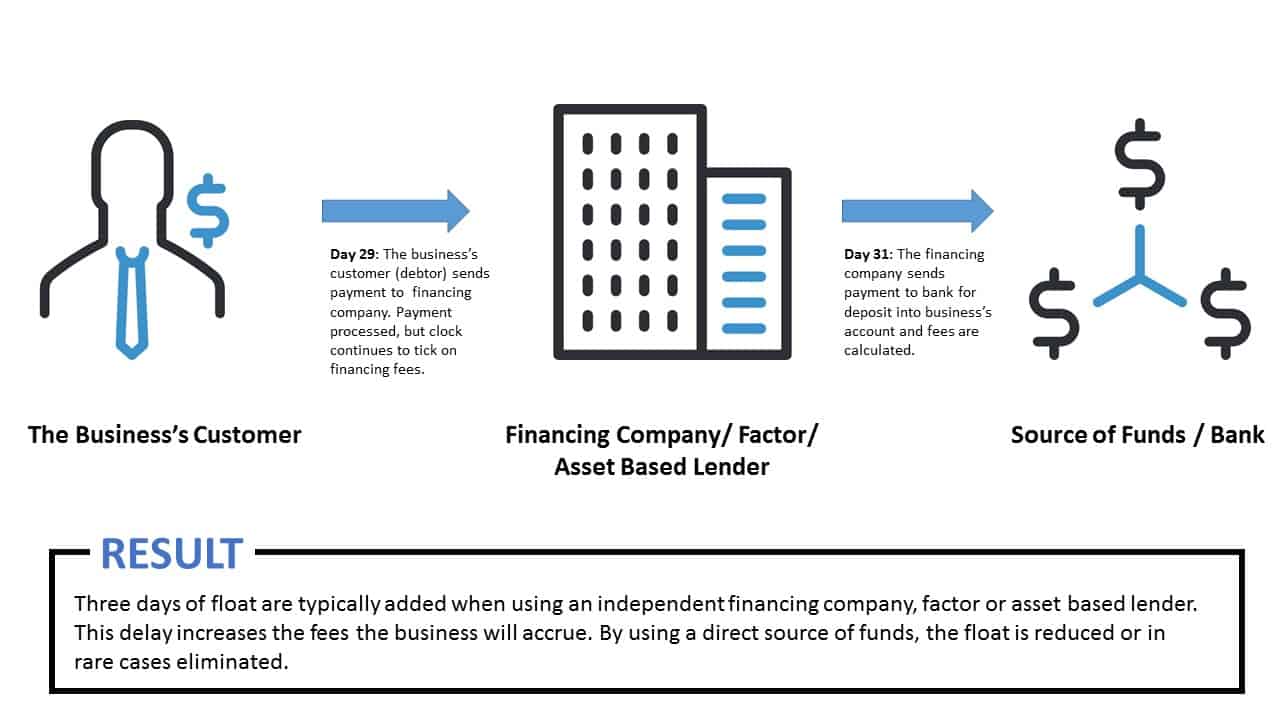

In finance, the term “float” can mean a lot of things. In invoice factoring relationships, float refers to the difference between the time the finance company receives a payment and when it gives the factoring customer credit for the payment.

Putting it in simpler terms, when payment is made by check or ACH, the transfer of money from bank account to bank account does not happen instantaneously. Instead, payments take a certain amount of time to clear. This period is often referred to as the float.

What are Float Days?

In a contract, float days are a time allowance for check clearance and may also be called clearance days. A specific number of float days will be outlined in the invoice factoring contract. Look for these in the fine print – float days are likely to be left unexplained and accepted at face value, but it’s important to recognize their impact.

Are Float Days Standard in Contracts?

Yes, float days are always present in invoice factoring agreements. First and foremost, the float provision helps protect the lender from bad checks or payments. Secondly, the lender continues to accrue interest during the float period. Three days is an industry standard, but longer terms of up to five float days is common.

How Do Float Days Affect my Factoring Rate?

Float days are additional calendar days tacked on to the date the payment is received. In financing relationships with simple interest rate structures, float days are relatively harmless.

However, in factoring relationships with tiered fee structures, float days can have an enormous negative impact on your true financing costs. In these structures, the float is akin to a hidden fee that many factoring companies utilize to increase their returns at the borrower’s expense.

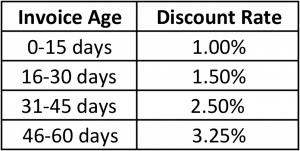

Let’s take a look at a real world example. Here’s a fee structure one of our customers had with an independent factoring company:

In this same contract, the factor had a 3 day float provision. 3 extra days of fees after a customer payment was received. No big deal, right?

Wrong. The impact of this tiered pricing structure with a 3 day float provision increased their annual financing costs by 42%. And the worst part was that they had no idea how or why.

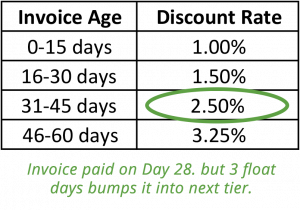

A Deeper Look at Factoring Float

This particular company had two large customers that were on Net 30 terms. These companies paid like clockwork via ACH on either day 28, 29, 30. According to the rate table above, an invoice received on day 28 would appear to be charged a factor fee of 1.50%. However, with a 3 day float the invoice is actually not credited until Day 31. The resulting factor fee is actually 2.50% of the face value of the invoice. What may seem like a small three day hold period actually equates to a 66% higher fee on those on time payments.

With these two large, prompt paying customers making up a significant portion of their business, the company’s annual financing costs were 42% higher – an increase entirely due to a tiered rate structure and 3 extra days of float.

The Impact of Float on Rate Table

Why Isn’t Float Discussed?

Most invoice factoring clients can tell you their discount rate, but don’t understand the impact of float. Float is often left out of conversations and proposals, and often unrecognized by borrowers well into a factoring relationship.

Since float days equate to higher fees, the topic is rarely discussed in significant depth. However, business owners should run the numbers to fully understand what the effective rate will be once float days are added into the calculation.

Why altLINE Is Different than Other Factors

Here at altLINE, we put an enormous emphasis on pricing transparency. Our goal is to ensure each customer knows exactly what they’re paying.

As such, our factoring program provides immediate reconciliation and application of debtor payments. More simply, when your customer payment arrives for a factored invoice in our lockbox or bank account, the interest and fee clock stops. Regardless of how long the money actually takes to “settle,” you receive credit for the payment the day it arrives.

This means, no more factored invoices mysteriously floating to hire fee rates, no more confusion, and at the end of the day – lower costs.

For more information about all aspects of invoice factoring, read our complete guide: how does invoice factoring work?