Everything You Need to Know About Owner-Operator Tax Deductions

Last Updated July 9, 2024

When it comes to running your own trucking company, few things are more important than properly managing your finances. This is especially true when it comes to taxes–or more specifically, tax deductions.

Filing taxes can be a major headache for owner-operators, but understanding which tax deductions are available for truck drivers makes the process more manageable and keeps more hard-earned money in your pockets.

In this article, we’ll dive into everything you need to know about owner-operator tax deductions so you can better manage your business budget.

Types of Taxes for Owner-Operators

First things first: owner-operator taxes look a little different than they do for company drivers. This is because owner-operators are business owners, so they aren’t just responsible for paying federal and state income taxes–they must also pay self-employment taxes.

The self-employment tax rate is 15.3% and is designed to cover Social Security and Medicare, two taxes that are usually covered by employers. Because of this, owner-operators must also file Schedule C and Schedule SE tax forms, in addition to the standard Form 1040.

It is also worth noting that as independent contractors, the owner-operator tax forms that you receive will be somewhat different from the tax form a company driver receives.

Company drivers receive a W-2 tax form, but companies must issue a 1099 for owner-operators they paid $600 or more in a year. Owner-operators use 1099 forms to report their income.

Owner-operators must pay estimated taxes four times during the year. As an owner-operator, this ensures you are paying taxes owed as you earn money, preventing you from having a massive tax bill at filing time. The IRS typically uses your previous year’s income to determine how much you’ll owe for each quarterly tax payment.

The good news is that these extra forms can be managed through digital tax software or a tax filing professional. Quarterly tax payments can be made directly to the IRS through their website.

So, with all that in mind, what owner-operator tax write-offs should you know about?

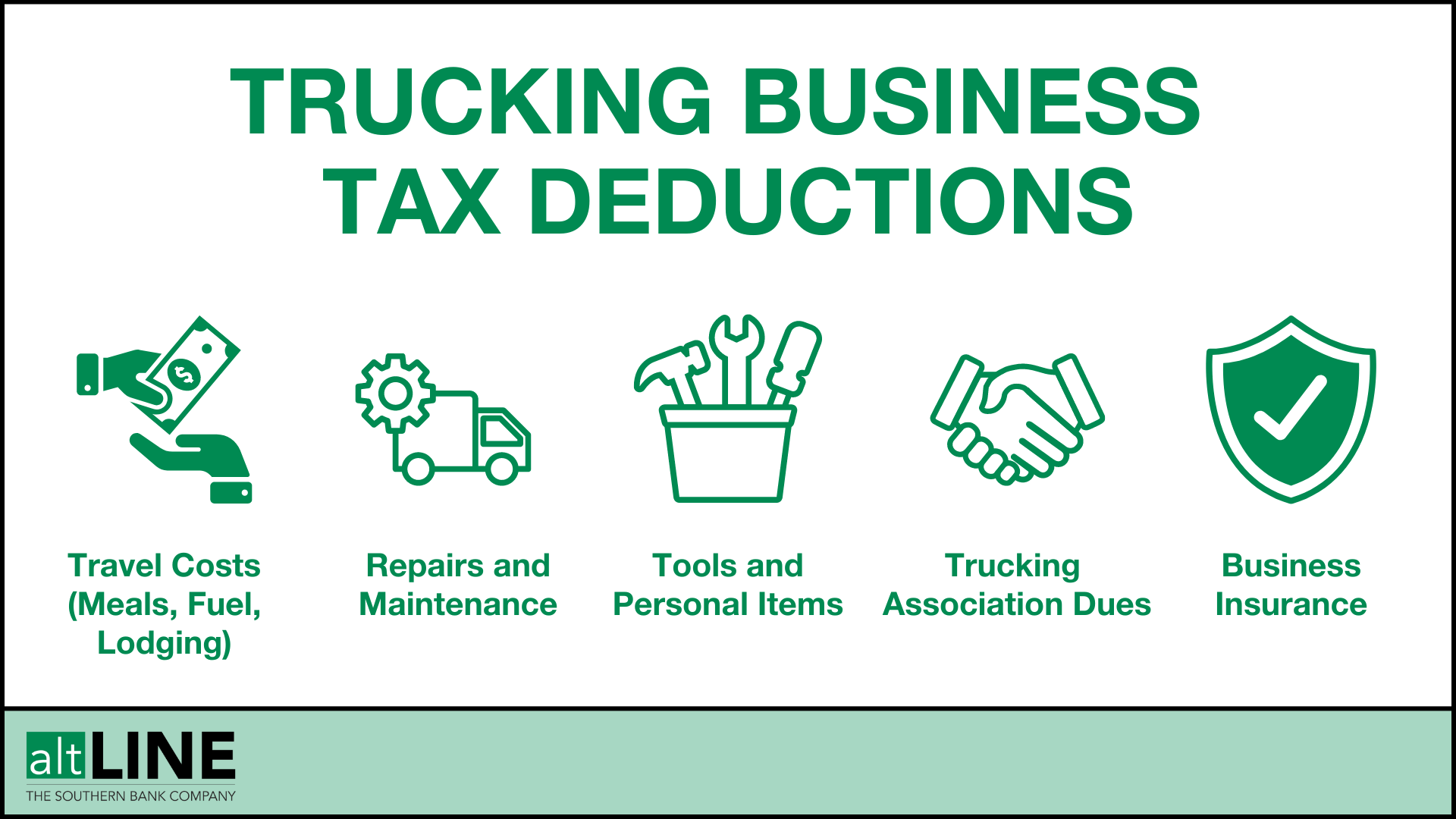

List of Tax Deductions for Owner-Operators

Unsurprisingly, one of the biggest questions for many owner-operators is: what can truckers write off on their taxes? There are several trucking company tax deductions available to claim to lower your tax liabilities.

• Association Dues: You can deduct membership fees and other related expenses if you’re part of a union or trucking association.

• Phone Plans: You can deduct 50% of your phone plan costs if you use your phone for both personal and business needs. You can also deduct the cost of a new phone.

• Education and Licensing: You can deduct expenses for ongoing training related to your work, as well as any licensing fees associated with your CDL license.

• Repairs and Maintenance: If you own your own vehicle, you can deduct repairs, maintenance, and even cleaning costs. This also includes a portion of the cost of new parts for your truck.

• Tools and Personal Products: You can deduct tarps, chains, bungee cords, wide-load flags, and other essential tools and equipment. You can also deduct personal products that you use for work, such as a cooler or a mini fridge, logbooks, or clothing.

• Travel Costs: Owner-operator tax write-offs can include mileage, fuel, tolls, and lodging expenses. While meals can be claimed at a per diem rate, truck drivers must submit actual lodging expenses. You can also claim depreciation on your equipment or loan interest for a financed truck.

• Business Insurance: Owner-operators can claim insurance premiums for their truck and business.

How Per Diem Works for Owner-Operators

Can truck drivers claim per diem? is a common tax-related question. The answer is yes—but not to the extent of other professions. Owner-operator per diem is limited to meals when on the road for long-distance driving and only when you’ll be away from home overnight.

The current truck driver meal deduction is $69 per day within the continental United States. Using the per diem rate can be much easier for claiming this deduction than tracking expenses from all your meals while on the road.

While other professions can claim a per diem for lodging, owner-operators must submit their actual expenses.

How to Track Business Expenses for Taxes

Keeping track of your business expenses is essential for helping tax season go smoothly. Good record-keeping will ensure you have all the necessary documents when it is time to file taxes.

1. Save All Receipts

If you plan to claim a deduction for a business expense, you must have the associated receipt. This means saving every receipt for business expenses. One way to simplify this process is to use a business credit card so you can maintain records of your spending via your monthly credit card statement.

2. Maintain an Expense Log

Information from your receipts should be categorized based on the type of expense incurred and recorded in a business expense log. Update your expense log promptly throughout the year so you can keep a running total of your business expenses for each category. A good rule of thumb is to add expenses to your log after completing a long-distance trip, or at the end of each week. Don’t save these updates for the end of the year, or you’ll be drowning in paperwork.

3. Simplify Tracking With an Expense App

There are several apps and online tools that can help you automatically track business expenses, store digital copies of paper receipts, categorize expenses, and even do all the math for you. The right accounting software can automate much of this process so tracking expenses doesn’t become a major burden.

Ways to Minimize Business Taxes for Owner-Operators

Understanding how to minimize business taxes is key for owner-operators who want to reduce their tax bill and improve their take-home pay. The following strategies can help.

Carefully Track Deductions

This bears repeating: few things can have a bigger impact on your business taxes than tracking your trucking company tax deductions. Saving and logging all deductible business expenses will allow you to maximize your savings during tax season by reducing your total taxable income.

Work With a Tax Professional

Working with a tax professional may seem like it will cost money, but working with someone who specializes in owner-operator expenses can help you identify overlooked deductions so you can minimize your tax bill. You can also claim their services for a deduction, since this is also a business expense. Finance professionals who specialize in trucking can also help with tasks like profit and loss statements and cash flow auditing.

Take Advantage of Tax-Free Savings

Saving for the future can lead to big tax savings. Making regular contributions to an IRA or SEP can help you save because a portion of your contributions are exempt from taxes. For example, you will only be taxed on IRA contributions when you begin to make withdrawals later. This will help reduce your taxes now, while also helping you save more for your retirement.

Potential Tax Credits for Truck Drivers

Tax credits can be even more helpful for reducing your tax bill. While deductions reduce how much of your income will be taxed, credits provide a dollar-for-dollar reduction of your tax bill.

Most tax credits for truck drivers fall under the same categories that can be claimed by other individuals. The child tax credit is one of the most commonly claimed credits, allowing you to reduce your tax bill based on how many children you have. The child and dependent care credit can also be a big help by covering a percentage of daycare costs for your children.

Notably, legislation has been introduced to create a refundable tax credit worth up to $7,500 for Class A CDL truck drivers who log over 1,900 hours per year. If passed, this tax credit could significantly lower business taxes for many truck drivers.

Owner-Operator Tax Deductions FAQ

Can truck drivers claim per diem?

Contractors and self-employed truck drivers can claim a per diem expense for their meals. Currently, the per diem rate for meals and incidental expenses is $69 per day when driving within the continental United States.

Can owner-operators claim mileage?

Yes. Owner-operators who own their own truck can claim the total mileage they drove their truck for work during the tax year.

Do owner-operators get a tax refund?

Owner-operators may get a tax refund on a case-by-case basis for expenses such as meals and any other incidental costs.

What can truckers write off on taxes?

Truck drivers can write off a wide range of business expenses, including insurance premiums, association dues, cell phone plans, medical expenses, dispatch fees, fuel and other travel costs, non-reimbursed repair and maintenance fees, licensing fees, and more.

What expenses can owner-operators not write off?

Owner-operators cannot write off deadhead miles and time off because the IRS already deducts them. Owner-operators also cannot claim deductions for time spent working on their own equipment.4

What happens if my business gets audited by the IRS?

If you get audited by the IRS, contact the CPA who helped with your tax return. Keep all business receipts for at least three years so you can provide them as needed during the audit process.

Where can I find an owner-operator tax deductions worksheet?

You can find several tax deductions worksheets online for owner-operators. We’re partial to this example, which offers a more detailed breakdown of income, vehicle expenses, and other common business expenses and truck driver tax deductions that you might be able to claim.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.