Trucking Industry Statistics, Trends, and Outlook for 2024

Last Updated May 22, 2024

The trucking and freight industry is vital to the United States economy, but it has experienced large swings over the last few years due to the COVID-19 pandemic and the post-pandemic recovery. The trucking industry suffered in 2023 with the National Truckload Index experiencing consistent declines since the start of the year. Moving into 2024, freight industry predictions are mixed due to an imbalance of supply and demand, in which there is a higher supply of trucking capacity than there is demand.

In this article, we’ve compiled 50+ trucking statistics to help you better understand the transportation industry, including truck driver salaries, common trucking challenges, women in trucking stats, and more. Keep reading to get a better idea of trucking industry statistics and market trends that can be helpful as you enter into (or grow within) the sector!

Trucking Industry Statistics

The COVID-19 pandemic shined a new light on just how important the trucking industry is to maintain a sound supply chain and support the economy. Both the global and United States trucking market sizes are expected to grow in coming years, despite the current challenges that truckers are facing. Below are some key trucking industry statistics to give you an idea of market size, market growth, and more.

- The US trucking market size was $217.3 billion as of 2022, and it is projected to grow at a 3.0% compound annual growth rate (CAGR) through 2027 (Zippia)

- This can be compared to the global trucking market size, which was estimated at $2.2 trillion in 2022 and is projected to grow at a 5.4% CAGR through 2030 to reach a size of $3.4 trillion (Research and Markets)

- The number of commercial trucks in the U.S. is estimated to be at least 12.5 million (Zippia)

- Trucks transport 73% of total freight value and 65% of total freight weight in the US (Transportation Statistics Annual Report)

- For comparison, trucks transported 8.5 times more freight volume than railroads did in 2020 (Transportation Statistics Annual Report)

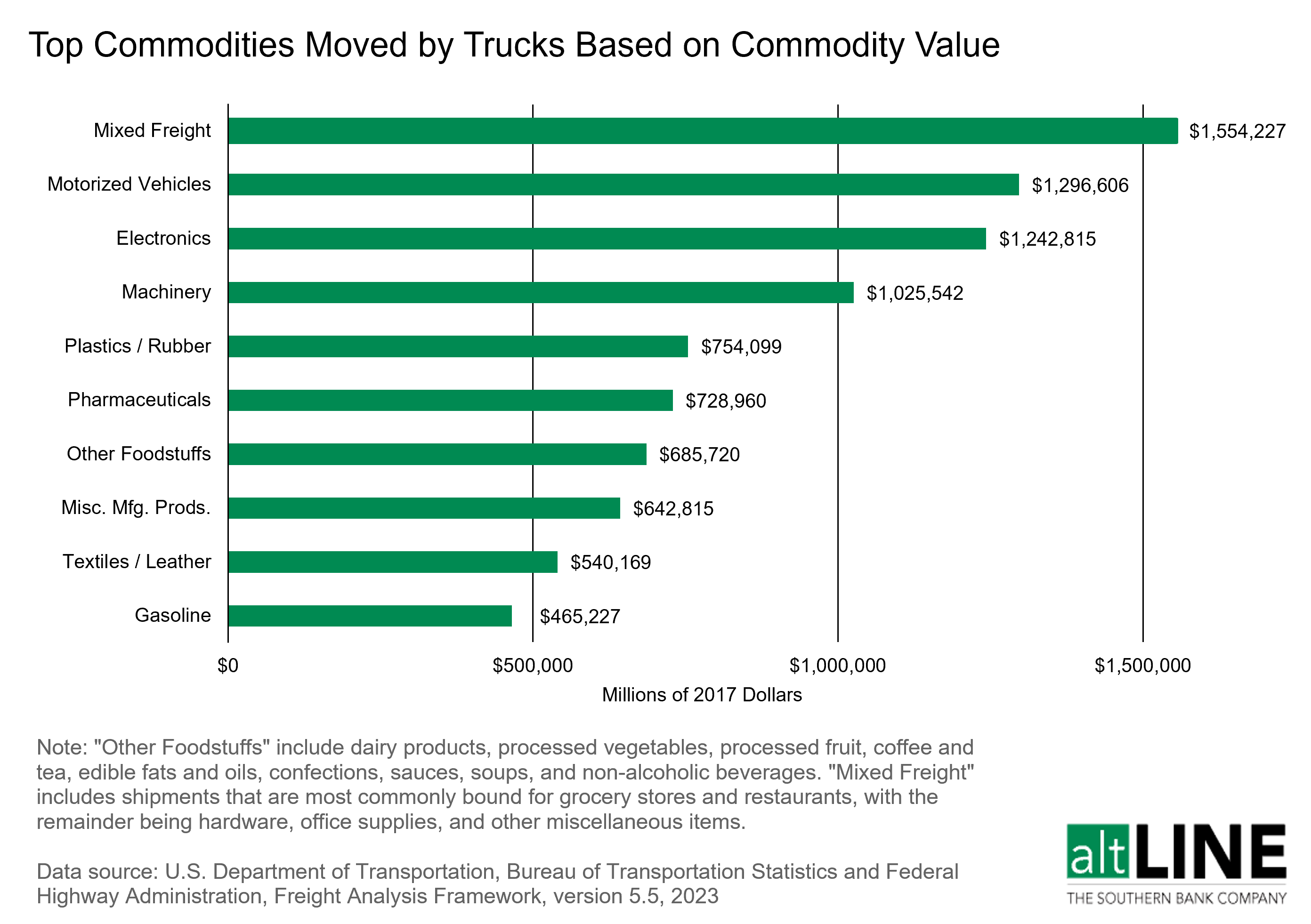

- Mixed freight and motorized vehicles are the top commodities moved by trucks, followed by electronics and machinery (Bureau of Transportation Statistics)

- Below are the top 10 largest trucking companies in North America by revenue (Zippia):

| Company | 2022 Revenue (in billions) |

|---|---|

| UPS | $100.3 |

| Fedex | $93.5 |

| J.B. Hunt Transport Service | $14.8 |

| XPO Logistics | $7.7 |

| Landstar System | $7.4 |

| Swift Logistics | $7.4 |

| Schneider National | $6.6 |

| YRC Worldwide | $6.5 |

| Old Dominion Freight Line | $6.3 |

| ARCBEST | $5.3 |

- The top 5 load boards that truckers use are (Owner Operator Independent Drivers Association):

- DAT (70%)

- Truckstop.com (47%)

- C.H. Robinson (30%)

- J.B. Hunt (23%)

- TQL (22%)

How Many Truck Drivers Are in the US?

According to the American Trucking Associations, 3.54 million truck drivers were employed in 2022, up 1.5% from 2021.

As of 2020, 4% of all male full-time workers nationwide were truck drivers, making it the most common occupation for men by far.” (US Bureau of Labor Statistics).

How Much Do Truck Drivers Make?

Truck driver salaries can vary quite a bit depending on the type of truck they drive, their level of experience, how much risk they’re willing to take on, etc. Because of this, you will find large ranges when searching for how much truck drivers make. In general, though, owner-operators make the most, while fleet drivers tend to make the least.

- The median pay in 2021 for heavy and tractor-trailer truck drivers was $48,310 per year (U.S. Bureau of Labor Statistics)

- The average salary for truck drivers with less than a year of experience is $86,900, while the salary for those with more than 10 years of experience is $104,502 (Indeed)

- In 2022, owner-operators under their own authorities saw the highest average compensation per mile, reaching $2.94, a 6% increase from 2021 (Owner Operator Independent Drivers Association)

- This can be compared to company drivers, who received an average compensation rate per mile of $0.72 in 2022 (Owner Operator Independent Drivers Association)

| Type of Truck Driver | Average Yearly Salary |

|---|---|

| Owner-Operator | $324,043 |

| Over the Road (OTR) | $111,772 |

| Team Driver | $110,125 |

| Car Hauler | $97,639 |

| Oversize Load | $96,532 |

| Tanker Driver | $89,036 |

| Less-Than-Truckload (LTL) Driver | $78,621 |

| Regional Driver | $75,877 |

| Delivery Driver | $69,245 |

| Reefer Truck Driver | $61,946 |

| Local Driver | $61,109 |

| Hazmat Driver | $57,554 |

| Ice Road Trucker | $56,348 |

| Dump Truck Driver | $52,512 |

| Route Driver | $51,128 |

| Fleet Driver | $29,992 |

Challenges in the Trucking Industry

Those that work in the trucking industry face unique challenges each and every day. From the frustrations of high insurances costs to the driver shortage to truck parking availability, truckers are consistently bombarded with new issues to consider in an ever-changing landscape.

- 21% of owner-operators report having difficulty finding loads to haul (FreightWaves)

- 61% of those that use a freight broker or third party say that the number of good loads are decreasing (Owner Operator Independent Drivers Association)

- In the past year, 77% of owner-operators booked shorter routes due to rising costs, and 65% booked fewer loads all together (Truckstop)

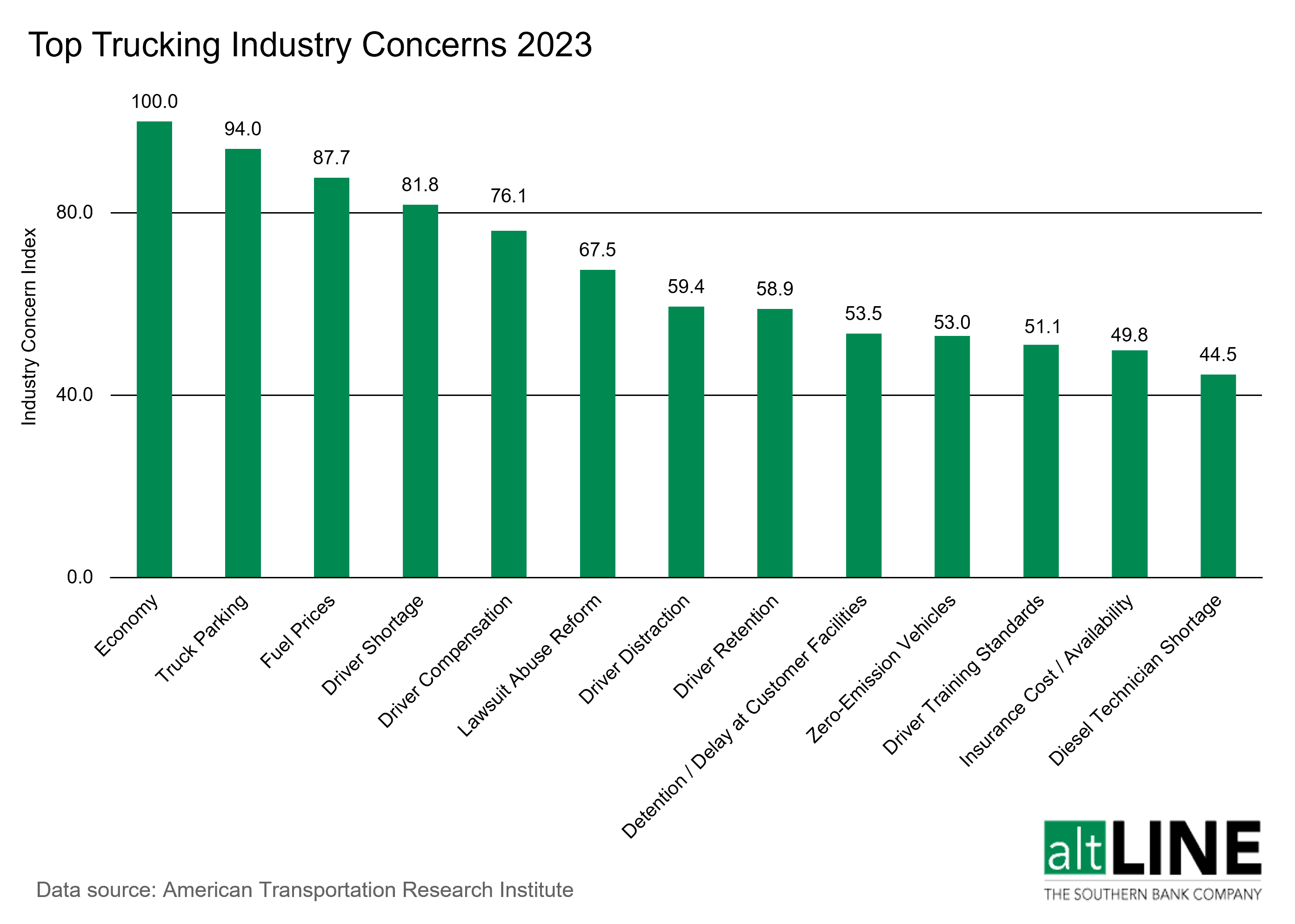

- The economy was ranked as the top industry issue in 2023, followed by truck parking availability, and fuel prices (American Transportation Research Institute)

- In 2022, 74% of US truck drivers were concerned about the pressure to work longer hours due to the truck driver shortage (Truckstop)

- 68% of US truck drivers found it difficult to keep up with insurance-related matters and changing industry regulations in 2022 (Truckstop)

- 70% of truck drivers believe that freight rates were decreasing in 2022 compared to the year prior (Owner Operator Independent Drivers Association)

- Only 6% of truckers believe that freight rates are at their peak right now (Owner Operator Independent Drivers Association)

- 67% of company drivers do not know how their carriers set their rates (Owner Operator Independent Drivers Association)

- While 54% of truckers stated that they always try to negotiate better rates, 56% of them said that the negotiation attempts resulted in them losing the loads (Owner Operator Independent Drivers Association)

Finally, a less quantifiable challenge lies in understanding how AI has affected the future outlook of trucking. It’s important for those in the industry to learn about how advanced technologies, and Artificial Intelligence in particular, have altered and will continue to alter specific roles and required skillsets in trucking.

The Costs of the Trucking Industry

The costs of operating a trucking business can change from year to year due to a variety of factors, including the cost of fuel, truck insurance premiums, trailer leasing costs, etc. In 2021, the cost of trucking hit its highest in 15 years, largely due to a jump in the cost of fuel, which saw a 35.4% increase year-over-year.

- The cost of trucking increased to a 15-year high in 2021, hitting $1.855 per mile, a 12.7% increase from 2020 (American Transportation Research Institute)

- The average operating cost per mile in 2022 was $2.38, an increase of 36% from 2020 (Owner Operator Independent Drivers Association)

- The managing director of recruitment at Centerline Drivers says that their “customers estimated the cost of a sitting truck is $500 – $1,500 per day, per truck” (SHRM)

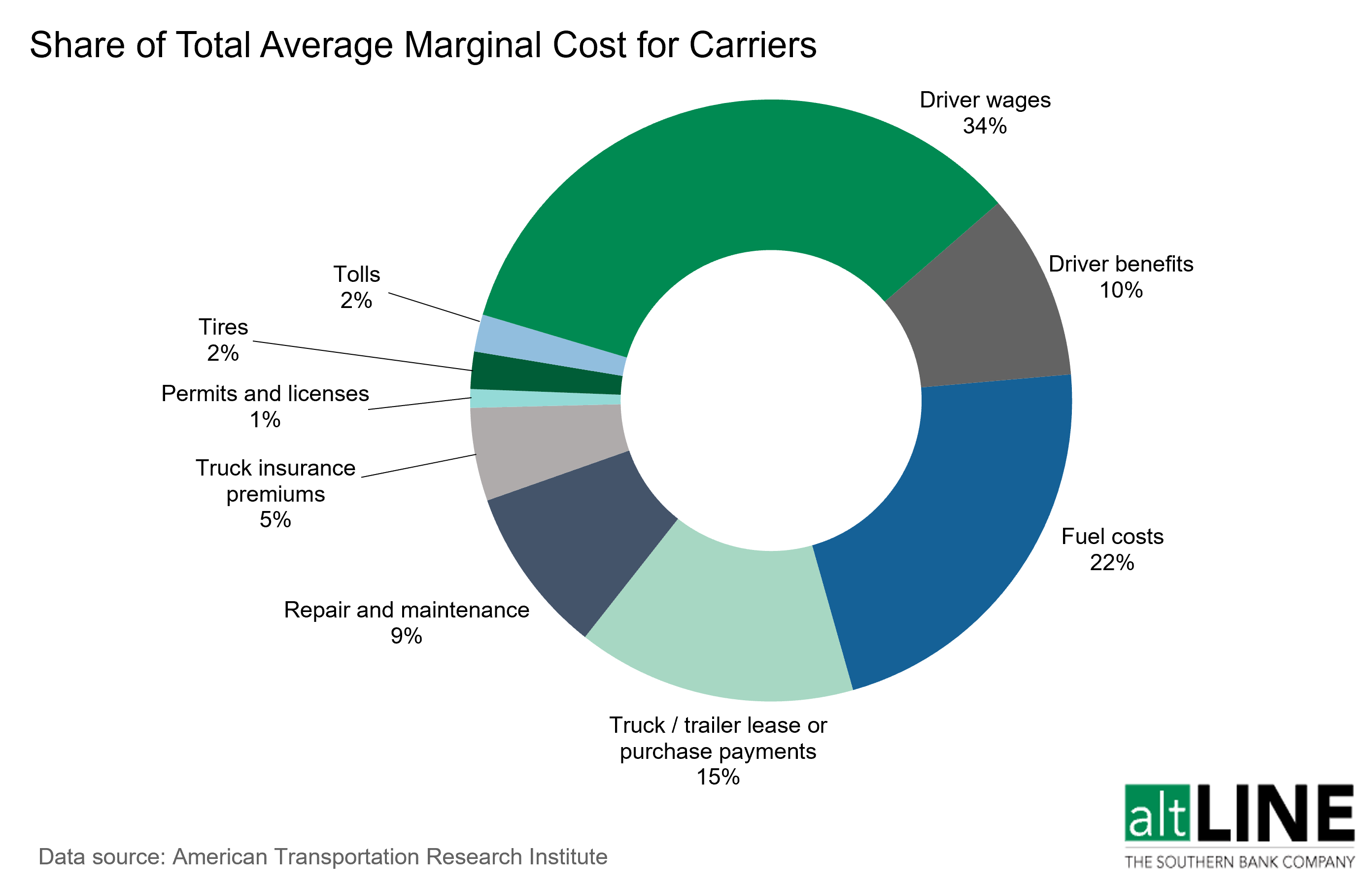

- Driver wages (34%) made up the largest share of marginal costs for carriers in 2021, followed by fuel costs (22%), and truck/trailer payments (15%) (American Transportation Research Institute)

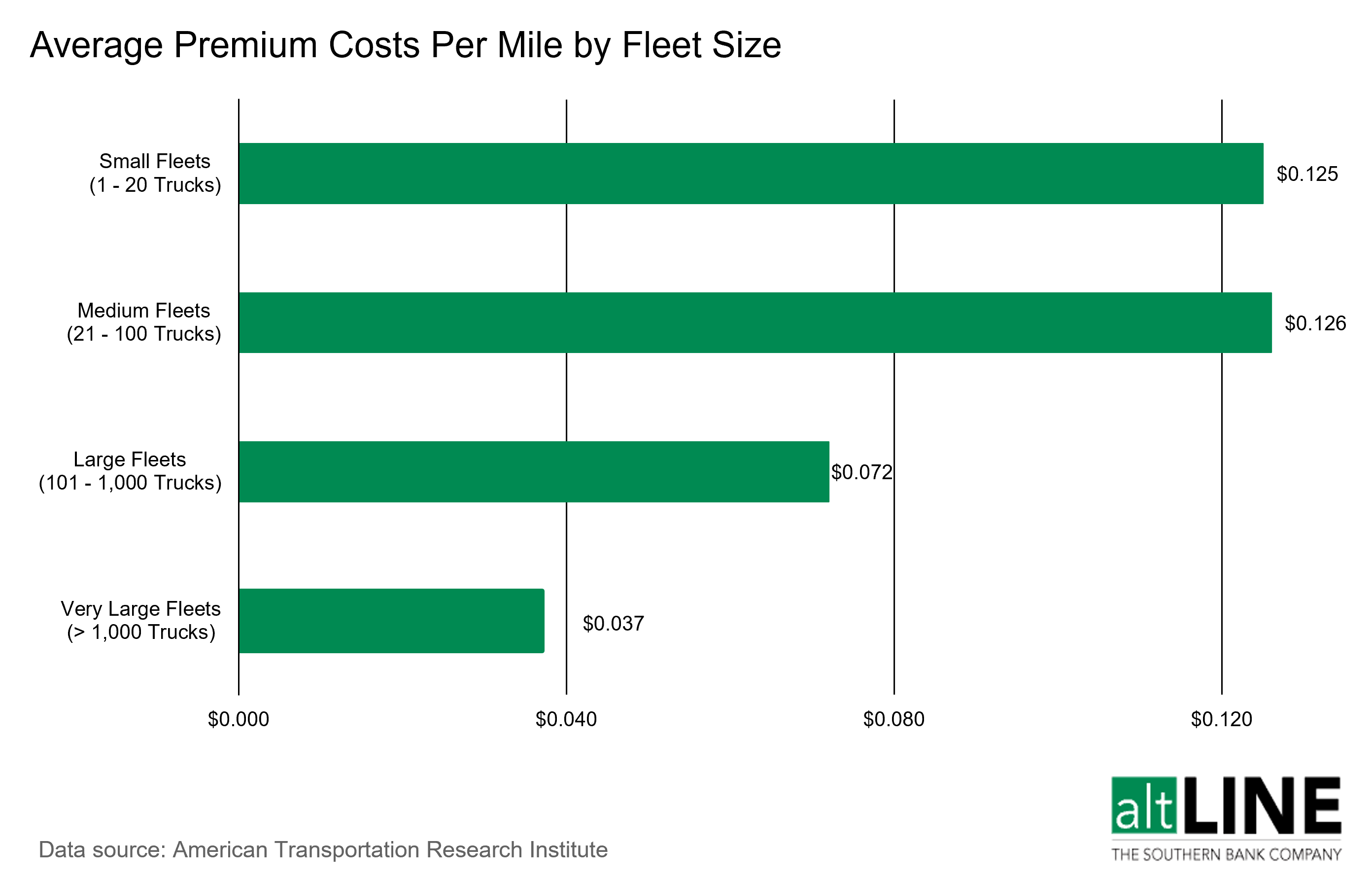

- The cost of truck insurance premiums increased 47% from 2010 to 2020, and the average premium cost per mile is highest for those that operate fleets of 1 – 20 trucks (American Transportation Research Institute)

- Truckers drove 25,387 deadhead miles in 2022, which are miles driven with an unloaded (or empty) trailer (Owner Operator Independent Drivers Association)

- In 2021, owner-operators spent, on average, $45,605 on fuel, which is about 48 cents per mile (ATBS)

- Owner-operators who knew their cost of operations earned $1.15 more per mile than those who did not know (Owner Operator Independent Drivers Association)

- 93% of owner-operators with their own authorities know their cost of operations (Owner Operator Independent Drivers Association)

- The average fee for freight factoring services in 2022 was 3% (Owner Operator Independent Drivers Association)

Women in Trucking

The trucking industry is incredibly dominated by men, especially in the driving profession. However, there are multiple organizations that are dedicated to improving gender diversity, bettering working conditions for women, and helping women establish successful careers in the trucking and freight industry. Some of these organizations include the Women in Trucking Association, Women in Trucking Foundation, Real Women in Trucking, SHE Trucking, and the USDOT’s Women & Girls in Transportation Initiative.

- 12.1% of professional drivers are women (Women in Trucking)

- 83% of women enter the trucking industry due to encouragement from a friend or family member (Women in Trucking)

- More than 55% of North American truckers believe that trucking is a safe industry for women to work in (Women in Trucking)

- The top 3 turnover predictors for women truck drivers are dissatisfaction with (Stay Metrics):

- The tractor

- The compensation for deadhead miles

- The hours worked

- Female truck drivers are generally safer than their male counterparts. Specifically, compared to women, men truck drivers are (American Transportation Research Institute):

- 76% more likely to receive a seat belt violation

- 51% more likely to disobey traffic signs

- 14% more likely to get in a crash

- 57% more likely to drive too fast

- Women account for an average of 31.6% of executives in the C-suite of transportation companies (Women in Trucking)

- 11% of carriers have marketing campaigns specifically targeted towards women (Women in Trucking)

Crime and Harassment in the Trucking Industry

Crime and harassment is much more common in the trucking industry compared to many other sectors. According to a recent US DOT and FMCSA study, women and minority men are most likely to experience harassment.

- About half of the harassment in the trucking industry is not reported, largely because the victims do not think it will make a difference (US DOT and FMCSA)

- Truck driver harassment is most likely to happen at truck stops, places where drivers pick up or deliver, and fueling stations (US DOT and FMCSA)

- 37% of truck drivers reported that either their company does not have or they do not know if their company has a harassment policy (Women in Trucking)

- 42.5% of truck drivers are aware of drivers who have experienced harassment or assault while sharing the cab with a trainer of the opposite gender (Women in Trucking)

- The data below overviews the most common types harassment and crime experienced by truck drivers (US DOT and FMCSA):

| Harassment or Crime Type | Women | Minority Male | Non-Minority Male |

|---|---|---|---|

| Being called a name they did not like | 59% | 52% | 51% |

| Received words that threatened to hurt them | 38% | 40% | 44% |

| Truck or cargo got vandalized | 17% | 26% | 25% |

| Got pushed or hit or physically hurt | 15% | 7% | 13% |

| Got threatened with a weapon, like a gun or a knife or a wrench or a tire thumper |

14% | 25% | 24% |

| Got touched inappropriately | 33% | 8% | 14% |

Traveling with Pets

Over half of US truck drivers travel with their pets, which may lead to reduced stress and a greater sense of companionship.

- 56% of US truck drivers travel with their pets (Truckstop)

- 50% of owner-operator truck drivers travel with their pets for emotional support (Truckstop)

- Of those that travel with their pets, 54% would consider a different job if they could not bring their pets with them on the road (Truckstop)

Freight Broker Statistics

Freight brokerages are a vital part of the trucking industry with a fifth of all freight going through a broker. However, operating a freight brokerage can be difficult as freight brokers run into their own unique challenges in the industry.

- 20% of all freight goes through brokers (FreightWaves)

- The US freight broker market is expected to grow to $90.7 billion by 2028 (FreightWaves)

- The number of freight brokers in the United States varies quite a bit depending on the source. For example, Zippia reports that there are more than 10,292 freight brokers, while IBISWorld reports that there are 91,849 freight forwarding brokerages and agencies in the US.

- Freight brokers in the US make an average of $64,832 per year (Indeed)

- Only a third of brokerage authorities remain active after two years (Freight 360)

- 78% of freight brokers spend significant time addressing fraud-related problems (Truckstop)

- 65% freight brokers have experienced a loss of productivity due to fixing their fraud-related issues, and a quarter of brokers have had to deal with legal issues as a result (Truckstop)

- Below are the most common forms of fraud that concern freight brokers (Truckstop):

- Double brokering (90%)

- Stolen loads (28%)

- Identity theft (23%)

- Stolen payments (15%)

Trucking Industry Outlook for 2024

After the rough year for the freight industry in 2023, there has been a lot of noise regarding the outlook for 2024. The economy became the top industry concern last year, and with uncertainty surrounding consumer demand, expectations for the trucking industry in the first half of 2024 are not high.

However, many experts expect the continued pandemic effects on the industry to lessen throughout the year and for some of the extra trucking capacity to exit the market, leading to a potential upswing for the operators that remain. There are many variables that could impact the market, though, including:

- The price of diesel

- Fluctuating interest rates

- Global trade disruptions

- Potential labor strikes

With so many unknowns going into 2024, the outlook for the trucking industry in the second half of the year is hopeful, but by no means certain.

Trucking Industry FAQs

Is the trucking industry growing?

Yes! Despite the somewhat dismal outlook of the trucking industry through the remainder of 2023, the trucking industry market size is expected to grow at a 3.0% CAGR through 2027. Additionally, truck driver jobs are expected to grow 6% through 2030.

How much is the trucking industry worth?

In 2022, the United States trucking market was worth $217.3 billion, and the global trucking market was worth $2.2 trillion.

Angela is the Director of Online Marketing at altLINE where she manages content production, marketing and sales operations, and digital PR. Angela joined altLINE in 2022 after several years of working in digital marketing across various industries including financial services and B2B. Angela loves creating content that helps readers better understand their financing options and helps them make informed decisions about factoring. Her work has been featured in publications like Search Engine Journal and Moz.