Last Updated December 2, 2025

While you may already have a good understanding of standard invoice payment terms, this doesn’t necessarily mean your cash flow problems will go away. Even when clients and customers agree on payment terms, many clients still don’t pay on time.

Delayed payments can create a serious cash flow crunch for your business. Fortunately, by getting creative with your payment terms and implementing dynamic discounting, you can provide additional motivation to encourage clients to pay on-time so you can avoid cash flow issues.

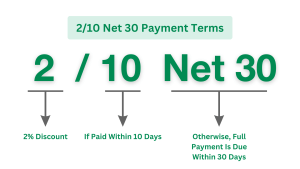

One of the most popular discounts that sellers include to encourage on time payments is 2/10 net 30. But since 2/10 net 30 terms aren’t quite as well-known as standard trade credit terms such as net 15 or net 30, let’s review what these discounted terms mean more in depth.

Key Takeaways

- 2/10 net 30 payment terms give buyers a 2% discount if they pay within 10 days, with full payment due in 30 days.

- Early payment discounts like 2/10 net 30 improve cash flow for sellers by reducing the average collection period and providing faster access to funds.

- Buyers benefit from early payment discounts by saving money and increasing available working capital for other business needs.

- Other common early payment discount options include 1/10 net 30, 3/10 net 30, and 2/10 net 45, allowing businesses to customize incentives for timely payments.

What is 2/10 Net 30?

If you’re new to invoicing, your first question after seeing payment terms 2/10 net 30 is undoubtedly, “What does 2/10 net 30 mean?” Fortunately, this dynamic discounting option, also known as a prompt payment discount, is relatively easy to understand.

2/10 net 30 sets the terms for an early payment discount. In this case, it means that the buyer or client will qualify for a 2% discount off their invoice total if they pay in 10 days or less. If the buyer submits their payment between days 11 and 30 after receiving the invoice, they will be responsible for the full invoice amount.

To break it down:

2 = the percent discount

10 = the number of days the buyer has to submit payment to receive the discount

30 = the number of days full payment is due, if the discount is not met

2/10 Net 30 Payment Terms Example

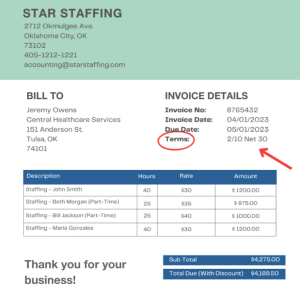

This 2/10 net 30 example can give you a better idea of what these payment terms could mean for your own invoices.

Using the example amount on this invoice template, we see that the client owes a total of $4,275 with net 30 payment terms. Two percent of $4,275 is $85.50. So, if the buyer was offered 2/10 net 30 payment terms and made their payment within 10 days, they would receive a discount of $85.50 and only owe $4,189.50. For the buyer, this $85.50 discount might not seem monumental, but if you’re like most businesses and you’re paying dozens of invoices per month, it can add up quickly.

When writing an invoice and offering an early payment discount, this information should be clearly communicated on the document itself. Showing how much a client can save and when they need to pay to get that discount will further incentivize prompt payment.

Benefits Of 2/10 Net 30

2/10 net 30 terms can provide business accounting benefits for both buyers and sellers, ultimately helping to create a win-win payment solution.

Benefit For The Buyer

For buyers, the potential to get a discount on the seller’s services is well worth the effort. Those “small” discounts can add up surprisingly fast, especially with large vendor orders. That extra 2% of available cash gives the buyer more working capital that can be invested for other uses and can help avoid cash flow problems.

Benefit For The Seller

For sellers, improving customer payment speeds and the average collection period ratio can also provide noteworthy cash flow benefits. Getting paid quickly gives sellers more time to put that money to use to support growth, build resilience against market issues, or take advantage of time-bound business opportunities.

The extra 20 days to work with 98% of the original invoice amount can ultimately be more beneficial than waiting the additional time to receive 100% of the payment. Offering discounts can also increase buyer retention, further strengthening business relationships and the lifetime value of each customer.

Other Common Early Payment Discounts

The following are a few other commonly used early payment discounts that you might wish to consider when sending invoices to clients. As with setting your payment terms, consider the needs of your business and your customers when deciding which type of discount to offer.

1/10 Net 30

With these payment terms, the buyer will only receive a 1% discount instead of a 2% discount for paying early (within 10 days) on net 30 terms.

3/10 Net 30

These trade credit terms can be very beneficial for the buyer, as a 3% discount is applied for paying within the first 10 days on net 30 terms.

2/10 Net 45

This discounted payment option is for business partners working on net 45 payment terms. A 2% discount is applied for payment within the first 10 days.

FAQ

What does 2/10 net 30 mean on an invoice?

2/10 net 30 means that if a buyer on net 30 payment terms submits payment within 10 days of receiving the invoice, they will receive a 2% discount. If they pay after 10 days, they will owe the full invoice amount.

Where do discounts go on the income statement?

When writing your income statement, discounts are typically reported as a deduction from your gross revenue. This would go as a line underneath the gross revenue total, typically noted as “Less: Early Payment Discounts” or something similar. You would subtract this and other sales discounts from your gross revenue to find your net revenue.

Can early payment discounts help me get paid faster?

Yes! Early payment discounts can be a powerful motivator for buyers to pay faster, since even a small discount will benefit their own working capital. Prompt payment discounts can result in faster payments and better relationships with your existing customers.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.