What Is 1/10 Net 30 On An Invoice?

Last Updated June 13, 2024

Rewarding customers who pay invoices on time is worthy of your time and effort, especially given the fact that a staggering 49% of B2B invoices become overdue. A common method sellers use to reward and encourage on-time payments is offering early payment discounts, such as 1/10 net 30.

Both parties in a transaction can benefit from 1/10 net 30. However, discounted payment terms aren’t as widely recognized as other standard invoice payment terms, so let’s first explain what early payment discounts are before jumping into 1/10 net 30 and the benefits of applying a 1/10 net 30 discount to customers.

What Are Early Payment Discounts?

Early payment discounts refer to discounts on sales invoices. Also referred to as “dynamic discounting” or “prompt payment discounts,” they provide an incentive for customers to pay an invoice in a timely manner.

Early payment discounts are typically only applicable for invoices that are paid in arrears. If you’re working on PIA (paid in advance) or COD (cash on delivery) terms, early payment discounts may not be an option.

1/10 net 30 isn’t the only early payment discount, which we’ll touch on a bit later.

What Is 1/10 Net 30 in Billing?

1/10 net 30 is an example of an early payment discount for an invoice on net 30 payment terms. At first glance, it may look confusing, but by breaking it down, you will quickly realize that 1/10 net 30 is actually a straightforward concept to understand.

Let’s break it down:

Net 30. These are the payment terms on the invoice. net 30 is an example of terms for a customer who is paying in arrears, or paying for a service after it has already been completed. On net 30 terms, the customer must pay within 30 days of when the invoice for a product or service was provided.

1/10. This is the early payment discount portion of the term, “1/10 net 30”. This means that if the buyer pays the invoice within 10 days of receiving it, they will receive a 1% discount. Thus, this could also be written out as 1%/10 net 30.

What Are the Benefits Of 1/10 Net 30 and Other Payment Discounts?

Early payment discounts such as 1/10 net 30 are usually a win-win for both the payor and the payee.

Benefits for the Buyer

The benefit for the buyer, or payor, is quite clear—it’s an easy way to save a bit of cash. Even if it’s only 1% or 2% on every invoice, that can add up quickly given that the average business handles up to 500 invoices per month. Even if your business isn’t dealing with large invoice quantities, it can still have a significant impact when making expensive purchases.

Say your small business pays around 100 invoices per month, with an average cost of $2,500. On 1/10 net 30 terms, you could save $25 per invoice, or $2,500 each month (100 x 25). In this scenario, by simply being a responsible customer and paying your invoices promptly, you would pay off the average sum of one invoice per month solely with the money you saved from early payment discounts.

Benefits for the Seller

For the seller, or payee, the benefit is twofold. First, it encourages prompt payment. As not getting paid on time is the No. 1 cause of cash flow issues for small businesses, it’s imperative to ensure you’re getting paid on time to avoid cash flow problems.

Providing a discounted payment option, so long as the invoice is paid quickly, is a great way to give your business the best chance to maintain as much working capital as possible and avoid having to figure out how to charge late fees due to slow-paying customers.

Secondly, 1/10 net 30 and other early payment discounts can improve the working relationship between buyer and seller. By offering 1/10 net 30 or another discount, it tells your business partner that you have their best interests in mind, as it allows them to save a percentage on every invoice.

Chemistry between buyer and seller is a highly underrated aspect of business. Two business partners with an honest and cordial relationship are much more likely to complete transactions smoothly and, most importantly, on time than business partners who don’t have a vested interest in each other’s success.

Example Of 1/10 Net 30

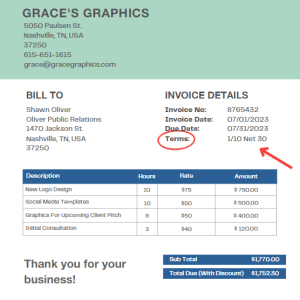

On the top right of the below example invoice, you see 1/10 net 30 payment terms.

The invoice was issued and received on July 1, meaning the receiver, Shawn Oliver of Oliver Public Relations, has until July 31 to pay $1,770 for Grace’s Graphics’ services.

On 1/10 net 30 terms, Mr. Oliver would receive a 1% discount if he paid the full value of the invoice by July 11. Therefore, he would end up being charged 1% less than $1,770, which is $1,752.30.

While the buyer saves some dollars, the main benefit in this situation is the supplier, Grace’s Graphics, receiving the $1,752.30 up to 20 days earlier than when she would have received it on standard terms thanks to the early payment option. Therefore, Grace immediately improves her working capital and accelerates her cash flow. Plus, she doesn’t have to spend time trying to figure out how to politely chase down customers for late payments.

Other Common Early Payment Discounts

1/10 net 30 isn’t the only common early payment discount. The discount terms can be adjusted based on the discount and net terms that you’d like to offer.

Some of the other most common early payment discounts include:

2/10 Net 30. Just as with 1/10 net 30, 2/10 net 30 offers customers a discount for paying for services within 10 days. However, this offers a 2% discount.

3/10 Net 30. This can be particularly beneficial for buyers, as a 3% discount is applied for submitting payment within the first 10 days.

1/15 Net 30. This discounted payment option means that if the invoice is paid within 15 days, rather than 10, a 1% discount is applied.

2/10 Net 45. This is an example of trade credit terms for business partners working on net 45 payment terms. A 2% discount is applied for payment within the first 10 days.

It should be noted that there are other types of trade credit terms as well; these are simply the most common. For instance, a buyer and seller working on net 60 terms might agree to 2/15 net 60. Essentially, any discount can be applied. If you’re selling a product, you should take into account your cash flow needs before agreeing to early payment discounts. Ultimately, it’s up to the two parties to come to an agreement on a reasonable discount that will benefit both sides.

In-Summary: 1/10 Net 30

Getting creative with payment discounts can drastically improve a business owner’s chance of getting paid on time. While 1/10 net 30 is arguably the most common of these early payment discounts, it can be helpful to read about other options as well, such as 2/10 net 30. And if you’re not working on net 30 terms, these obviously won’t be an option, so you’ll have to explore other early payment discounts.

Regardless, what’s most important is to be proactive. If your customers are paying slowly or regularly missing the due date, you need to reach out and find a solution. For small businesses especially, customer payment habits can play a major role in dictating cash flow.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.