Cash Flow vs. Revenue

Last Updated October 12, 2023

Navigating the complexities of business finances can be daunting, especially for small business owners who wear multiple hats. Understanding cash flow and how it differs from revenue is critical for the financial health of your company. While the two terms may sound similar, they have different meanings, and to ensure the financial success of your business, it’s important that you understand the nuances between these metrics. In this article, we will overview what cash flow is, what revenue is, and how these two numbers differ from one another.

What Is Cash Flow?

Cash flow is the movement of money in and out of your business. It’s not just the money you earn; it’s also the money you spend. The goal of any business is to have more money flowing in from sales, investments, and other revenue streams than flowing out for expenses like salaries, utilities, and rent.

What Is the Formula for Cash Flow?

As mentioned above, cash flow, or net cash flow, is the total movement of cash in and out of a business. To calculate net cash flow, you need two numbers:

- Cash inflow – the total cash coming into your business during a given time period

- Cash outflow – the total cash going out of your business during a given time period

Using these two numbers, you can calculate net cash flow as follows:

Cash Inflows – Cash Outflows = Net Cash Flow

Understanding Cash Flow

When operating a business, ideally your cash flow would be positive, meaning more cash is coming into the business than going out. However, this is not always the case. In fact, one of the biggest reasons companies fail is due to cash flow problems, causing negative cash flow and potentially resulting in long-term financial issues.

While positive cash flow is the goal, negative cash flow does not necessarily mean that your business will fail. It’s important to evaluate the cause of your negative cash flow to better understand how it will impact your business in the long run.

For example, is the flow of cash out of the company caused by business growth and a need for greater investment in operations? Business expansion can cause temporary cash flow declines but can drive increases in revenue and profit down the line.

On the other hand, if your negative cash flow is not intentional, such as the result of late customer payments or poor financial planning, your company could face financial issues over a long period of time. This is when negative cash flow becomes a greater concern and potentially detrimental to your business.

Why Is Cash Flow Important?

You may wonder why we’re putting so much emphasis on understanding cash flow. Improving cash flow is what allows you to make investments to grow your business, whether that’s hiring new staff or investing in marketing.

Without adequate cash flow, you may find yourself at the mercy of loans and credit cards with high interest rates, ultimately leading to a cycle of debt that can sink your business. And it can be especially cumbersome to deal with if your customers aren’t paying their bills on-time.

Be sure to monitor your net cash flow and keep an eye on metrics such as your cash flow to sales ratio and cash flow margin so that you can identify potential problem areas before they are too big to deal with.

What Affects Cash Flow and Cash Flow Changes?

There are numerous factors that can affect your cash flow. Seasonal sales fluctuations, customer payment delays, and unexpected expenses can all cause shifts.

For example, if you operate a seasonal business like an ice cream parlor, your cash flow will differ significantly in the winter when buying ice cream is much less popular. Running your own business presents challenges, but understanding the variables that affect your cash flow can prepare you for financial storms.

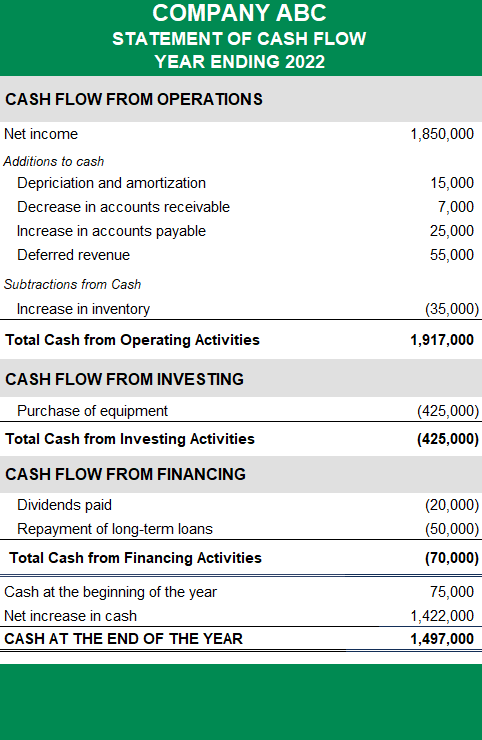

Cash Flow Statement

A cash flow statement provides an immediate snapshot of your financial health, showcasing how cash is flowing in and out of your business by revealing actual cash movements over a past period, categorized into operating, investing, and financing activities. Cash flow statements should be prepared, at a minimum, on an annual basis, but creating these documents more frequently, such as monthly or quarterly, can help you keep a better pulse on your business’s cash movement and identify problem areas as they arise.

How to Improve Cash Flow

Improving your cash flow isn’t just about making more sales; remember, every financial decision you make will impact cash flow. Therefore, it’s also about efficient management of your resources. Quick invoicing, cost-cutting where possible, and wise investment are all avenues to explore. Below are some more specific tips to increase your cash flow:

- Charge late fees on invoices – this can encourage quicker payment by customers, bringing cash into your business faster.

- Offer flexible payment options – rather than requiring customers to pay by check or send payment through the mail, offering flexible payment options, such as credit/debit card payments and ACH transfers, can quicken the payment process.

- Pay your invoices more slowly – if you have longer payment terms, use them to your advantage. Payment terms such as net 30, net 60, or net 90 allow you to pay your invoices more slowly, keeping cash in your business for longer and allowing you to be more flexible with how you manage your expenses.

What Is Revenue?

Revenue is the total amount of money generated by business operations, such as the sale of a product or service. Unlike cash flow, revenue gives you a measure of your business’s top line earnings, which doesn’t account for operating costs or other expenses. To fully grasp the financial landscape of your business, understanding the difference between cash flow vs. revenue is vital. It’s equally important, however, to stay on top of both metrics.

What Is the Formula for Revenue?

You will find that the formula you use to calculate revenue differs, depending on if you are tying to calculate gross revenue or net revenue. Gross revenue is the top-level income that your business generated, while net revenue takes into account other considerations, such as allowances, discounts, and returns.

Gross revenue is simpler to calculate than net revenue. The formula is as follows:

Quantity Sold * Unit Price = Gross Revenue

This basic formula takes the total number of units sold and multiples it by the price per unit. So, for example, if you sold 100 mugs at the unit price of $5 per mug, your gross revenue would be:

(100 * $5) = $500 in Gross Revenue

However, some business owners also want to take into consideration details such as the number of returns you had, allowances offered to customers, and discounts provided. To do this, you would use the following net revenue formula:

(Quantity Sold * Unit Price) – Discounts – Allowances – Returns = Net Revenue

To see an example of how net revenue compares to gross revenue, consider the same mug example above. Let’s say that you’ve sold the 100 mugs at the price of $5 per mug, but 10 of the mugs were returned to you and 20 of 100 the mugs sold were at a 50% discount, resulting in the following discounts, allowances, and returns:

- Discounts: $50

- Allowances: $0

- Returns: $50

You would then calculate net revenue as follows:

(100 * $5) – $50 – $0 – $50 = $400 in Net Revenue

As you can see, the gross revenue was $500 while the net revenue was $400 because net revenue took additional considerations into account.

Understanding Revenue

As previously mentioned, revenue is a top line metric, meaning it does not take into consideration business expenses. Revenue is often evaluated alongside other financial metrics, such as profit, to get a more holistic understanding of company performance. Because revenue is directly related to business operations and the number of units sold, the best ways to increase revenue are to sell more units or increase the price of the unit. However, keep in mind that more revenue does not mean more profit, as profit includes expenses in its calculation.

Why Is Revenue Important?

The question may seem straightforward, but the nuances are critical. Revenue acts as a business’s lifeblood. While cash flow provides a snapshot of liquidity, revenue indicates the market demand for your products or services. Without sufficient revenue, sustainable cash flow becomes a challenge. To dig deeper into this topic, check out these small business revenue statistics.

What Affects Revenue and Revenue Changes?

Revenue can be affected by market conditions, competition, and customer behavior, among other factors. Seasonal trends can also have a profound impact, and sometimes, you may have to accept that you won’t ever necessarily be fully able to control your revenue – take a recession, for example, or the COVID-19 pandemic.

Though similar to cash flow, understanding how these variables affect revenue will help for long-term planning.

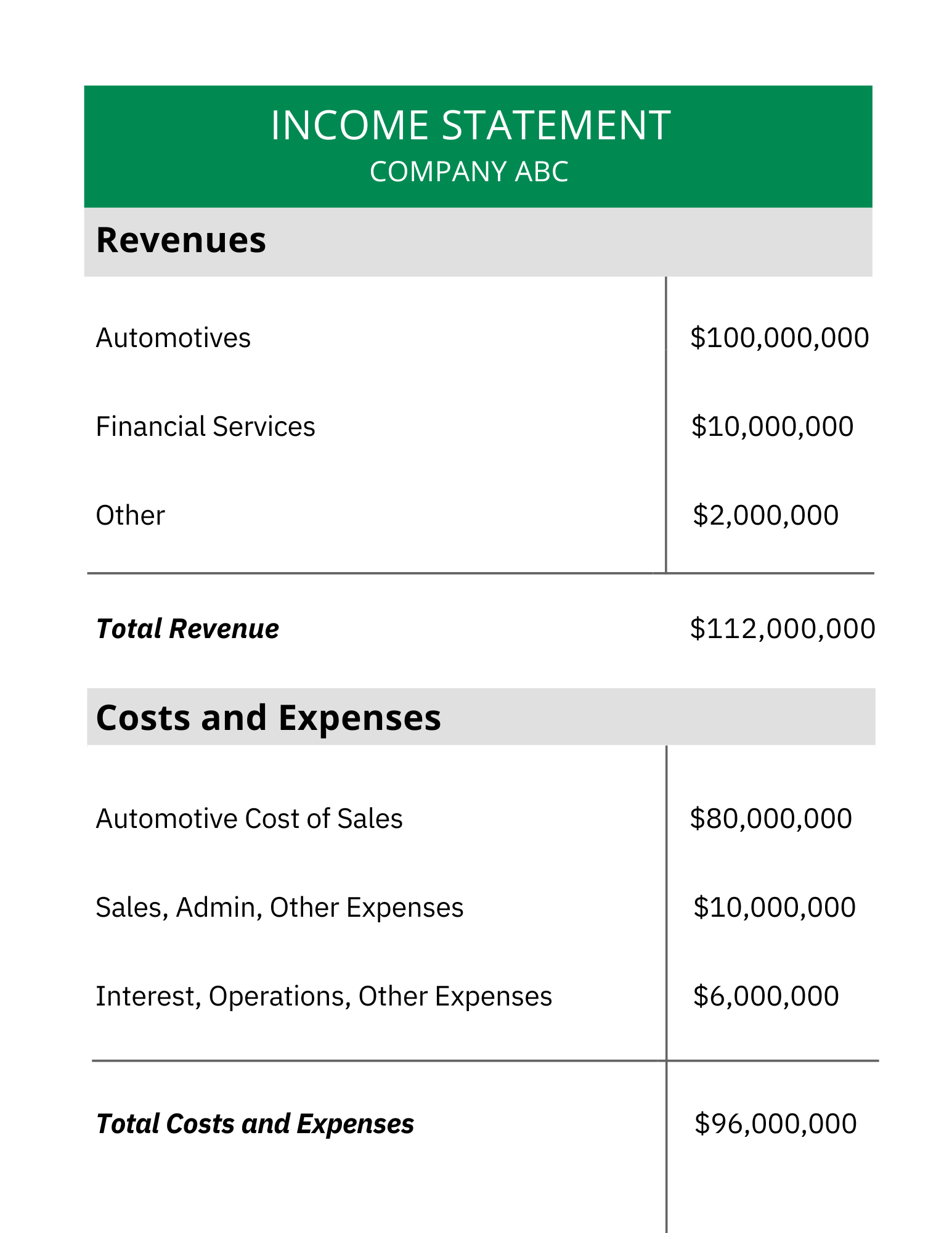

An Income Statement’s Importance to Revenue

An income statement, also known as a profit and loss statement, will often include revenue on the top line, followed by costs and expenses to arrive at a net profit. This differs from a cash flow statement, which focuses on where money flows in and out of a company. Make sure you’re creating an income statement annually, if not quarterly, to determine and better understand your revenue.

How to Improve Revenue

When considering how to improve revenue, tactics like diversification, market expansion, and pricing strategies come to mind. However, revenue improvement can be as simple as increasing your prices or holding a sale to increase the quantity sold. Revenue is also largely tied to your marketing efforts and the demand for your products or services, so focusing more on how you acquire and retain customers can lead to revenue improvements.

Cash Flow vs. Revenue: What’s the Difference?

To understand the difference between cash flow vs. revenue, let’s break down some key points:

| Cash Flow | Revenue | |

|---|---|---|

| Definition | The movement of cash and cash equivalents in and out of a business. | The total amount of income generated from sales before expenses |

| Formula | Cash Inflows – Cash Outflows = Net Cash Flow | Quantity Sold * Unit Price = Gross Revenue

(Quantity Sold * Unit Price) – Discounts – Allowances – Returns = Net Revenue |

| Purpose of Analyzing | To measure how effectively a business uses its cash and how well it can sustain its operations in the short term | To measure the effectiveness of sales, marketing, and pricing structures |

| Types | Operating cash flow, investing cash flow, and financing cash flow | Gross revenue, net revenue, deferred revenue |

| Frequency of Analysis | Typically reviewed monthly, quarterly, or yearly | Typically reviewed monthly, quarterly, or yearly |

| Financial Statements | Reflected in the cash flow statement | Reflected in the income statement |

Example of the Difference Between Cash Flow and Revenue

To understand the distinction between cash flow vs. revenue, consider a clothing retail business. Imagine that in the first quarter, the store’s sales amounted to $50,000. This figure is the revenue.

However, during the same period, the store underwent a renovation to create a more appealing and modern environment, resulting in $60,000 of expenses. Taking this cash outflow into account, the clothing retail business would actually have a net cash flow of -$10,000.

Here, we can see a clear difference between revenue ($50,000) and cash flow (-$10,000) as the revenue gives an optimistic view of the sales performance for the quarter but the negative cash flow raises some red flags. However, in this particular case, the store renovation was an expected investment to improve the customer experience, so if the business owner was properly managing their cash flow, this should not be a cause for concern.

Using Cash Flow-to-Sales Ratio to Analyze Cash Flow vs. Revenue

The cash flow-to-sales ratio is a useful metric for assessing the relationship between cash flow and net revenue. This ratio measures how efficiently a company converts its sales into actual cash. To calculate this ratio, you divide the cash flow from operations by net sales. A higher ratio typically indicates better liquidity and operational efficiency, answering the question: what is a good cash flow to revenue ratio?

Cash Flow vs. Revenue FAQs

Is revenue the same as income?

Revenue and income are often used interchangeably, but they are not always the same. Revenue refers to the total amount of money generated from sales before any expenses are deducted. Typically when people discuss “income”, they are referring to “net income,” which is what remains after all costs, taxes, and other expenses have been deducted from the revenue.

What is a good cash flow to revenue ratio?

A good cash flow to revenue ratio varies by industry and the financial structure of the business, but generally, a higher ratio indicates a healthy financial position. A ratio above 0.2 or 20% is often considered good (though this can vary quite a bit from business to business), as it suggests that a significant portion of revenue is being converted into cash, making it easier for the business to meet its short-term obligations and invest in growth.

What’s the difference between gross revenue and net revenue?

Gross revenue is the total amount of money generated from sales without any deductions. Net revenue is the amount remaining after subtracting returns, allowances, and discounts from the gross revenue.