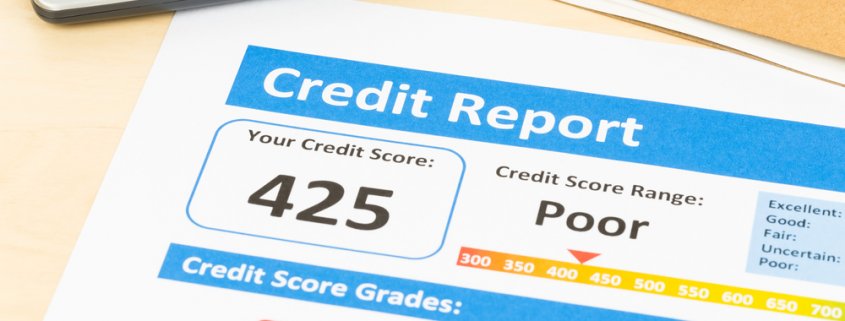

Is Invoice Factoring Possible with Bad Credit?

Last Updated November 2, 2023

Your business might turn in a profit on paper, but if cash flow is limited, covering operational expenses can be a challenge. But for businesses with bad credit or a limited credit history, finding funding to cover expenses isn’t so straightforward. That’s where alternative financing options such as invoice factoring come into play.

Factoring is an alternative financing solution for business owners who are working on building business credit or improving from a low score. Let’s dig into how factoring works.

How Does Invoice Factoring Work?

Most businesses have 30-day or sometimes longer terms for paying invoices. While you wait for a payment from a client, you might struggle to find the cash to pay for invoices from your suppliers, or take care of expenses like payroll, rent, or even utility bills.

Invoice factoring is a financing solution tailored to solve this problem. First, you sell outstanding accounts receivables to a factoring company (a “factor”). In return, the factor will send your business an immediate cash advance of 80-90% of the value of each invoice. Then, once your customer submits payment to the factor, the rest of the money is released to your business, minus a small factoring fee.

What Are the Benefits of Factoring?

The main benefits of factoring your invoices are:

1. Predictable cash flow for your business

2. An immediate working capital boost

From the moment you invoice your customer, you’ll have access to cash to take care of your immediate expenses and liabilities. If your customer decides to use the entire length of your agreed-upon terms to pay the invoice or they pay late, that won’t hinder your business’s financial growth.

Another advantage is that the invoice factoring company is in charge of collecting payments from your customers. Invoice factoring can help you save a lot of time, especially if you have to send multiple reminders at the end of an invoice term, allowing you to focus on other important tasks.

How Do Invoice Factoring Companies Determine Their Terms?

Invoice factoring rates and fees, and the percentage of the accounts receivables they can give you upfront, are typically adjusted based on a few factors.

First, and perhaps most importantly, a factor will look into your customer base to assess the risks they are taking by giving you cash upfront for your accounts receivables. This involves a thorough customer background check. The main point to remember when it comes to factoring: your customers’ creditworthiness is more important than your own business’s creditworthiness.

This is one of the biggest selling points of factoring for small business owners. It’s why it’s such a common financing solution for new business owners in particular.

Additionally, factoring companies will look at your industry, the volume of invoices you want to factor, and the average number of invoices that are outstanding.

If you have a long history of working with the same customers who always pay you on time, you will get better terms for invoice factoring. The invoice factoring company will also offer a higher upfront percentage for your accounts receivables if you have a large customer base since working with multiple customers makes you more resilient in case one of them doesn’t pay an invoice.

On the other hand, working with customers that you acquired recently can make you eligible for less advantageous terms. However, you can negotiate a recourse or non-recourse contract with an invoice factoring company:

- A recourse contract means that you will buy back any unpaid invoices. You can get better terms since you’re taking on the risk of having a customer not pay an invoice, and the invoice factoring company won’t lose any money in this scenario.

- Invoice factoring companies also offer non-recourse contracts. If you opt for this option, the factoring company will absorb the loss if a customer doesn’t pay an invoice. You will pay a higher fee for this service since the invoice factoring company is taking more risks.

Does Your Credit Score Matter for Invoice Factoring?

No, your business credit score has no impact on the invoice factoring application and approval process. It also has no impact on the rates you will get.

Your invoice factoring provider is going to look at your accounts receivables to determine the terms they can offer, focusing on money that customers owe you and how likely these customers are to pay invoices on time.

A business with bad credit or a limited credit history can qualify for invoice factoring since credit doesn’t reflect an ability to receive money from your clients. Your personal credit score isn’t particularly important either.

Do Factoring Companies Perform Credit Checks?

Invoice factoring companies will perform a credit check on your customers. A dependable factor should have a vetting process designed to assess the creditworthiness of your customers.

Looking into the credit history of your customers tells the invoice factoring company whether they are managing their credit lines responsibly and paying invoices on time. Having multiple customers with a good credit score and a strong credit history means you will qualify for better invoice factoring terms.

However, note that working with customers who operate new businesses with a limited credit history or who have bad credit scores won’t disqualify you from invoice factoring. It just means you’ll get a smaller percentage upfront or only qualify for a recourse contract.

You can also get better terms if you have a large customer base rather than relying on a few major clients for the bulk of your cash flow. The more clients you have, the smaller the impact of an unpaid invoice will be.

If you want to mitigate risks and get better terms, focus on acquiring new customers that have been around for a while. An older business should have more experience with managing credit and their creditworthiness should be higher.

Does Utilizing Invoice Factoring Affect Your Credit?

Invoice factoring has no direct impact on your business credit score. Your business credit score only reflects the payments you make, not the ones you receive.

However, invoice factoring can indirectly improve your chances of boosting your business credit.

For instance, getting paid faster for your invoices makes you less likely to miss a business loan payment, credit card payment, or payment to a vendor. A late payment can cause your credit score to dip significantly, which is why cash flow is so important for improving your credit score. Factoring provides a cash flow boost.

Factoring also makes you less dependent on credit. You’ll have sufficient cash flow to cover your operational expenses and can reserve your credit lines for things like unexpected expenses or investments. It’s easier to plan for optimal credit utilization when you have a predictable cash flow.

If you combine invoice factoring with using your cash flow to manage your credit lines responsibly, invoice factoring will help you improve your business credit score.

How Invoice Factoring Supports Business Growth

Obtaining financing can be tough for news businesses. A limited credit history means you’ll have fewer lending options at your disposal. Many business owners rely on undesirable alternatives, such as resorting to expensing business purchases onto personal credit cards. In fact, 46% of small business owners end up using personal credit cards to finance their business ventures. While they might qualify for better terms, it means that they will remain liable for any debt the business incurred, even if they go bankrupt.

Invoice factoring is not one of these undesirable alternatives. Instead, it’s a proven solution that small business owners turn to because it supports growth.

By factoring, you can improve your cash flow, make payroll without worry, and keep up with other operating expenses without stressing over cash. All of these benefits support business growth.

Plus, if you choose to factor with a bank such as altLINE, that will be noticed and rewarded by potential future lenders. For instance, you may eventually reach a point where you need to apply for a traditional bank loan to finance a large-scale project. When you’re applying for those loans, a bank will see that you’ve had a successful relationship with a reputable factor in the past, giving your business a better shot at being approved for those loans. You’ll also be offered better rates.

Wrapping Up

Bad credit or a limited credit history won’t get in the way of your business qualifying for invoice factoring. Your business can obtain funding even with bad credit!

However, the creditworthiness of your customers will have an impact on the terms and rates the invoice factoring company can offer. You’ll get better terms if you have a varied customer base or work with customers who have strong credit histories.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.